Contingency Plan Hard Fork Controversy Revealed

Bitcoin network has been starting to question and having debates on the capability of a hard fork over the past few days which got viral and its possibility of blockchain split.

- Overview - Table of Contents

- Bitcoin Exchanges Revelation

- Statement of Coinbase

- Listing Pairs of Bitfinex

- Community Topic Continuation

Bitcoin Exchanges Revelation For Hard Fork

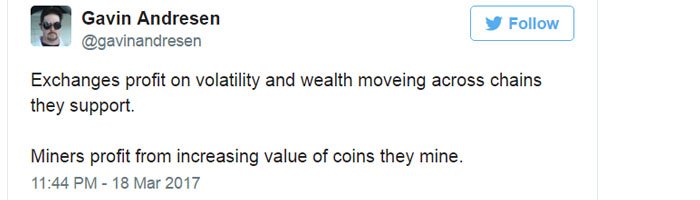

On 17th of March, about 20 of the most popular Bitcoin exchanges stated their concern towards a network spilt and hard fork speculations. Their statement tackles about their business plan pattern which hard fork situation arises.

Those exchanges who signed the paper also intended to list down their respective plans in case there will be blockchain split which notes about token assets. Listings for BU or Bitcoin Unlimited protocols and Bitcoin Core will be included. Some of the exchanges signed the letter includes Kraken, Bitsquare, Shapeshift, BTCC, Bitstamp and more.

They explained that they have decided to assign the Bitcoin Unlimited of BU as BTU or XBU. The implementation of Bitcoin Core on the other hand will be continuing to trade as XBT or BTC and all of them will be processing the deposits as well as the withdrawals in BTC no matter what the hashing power of BTU chain would look like.

In any case, the announcement of how trades would assign the names of the tokens recorded has turned into a disagreeable issue for those supporting BU. Moreover, the group and two signatory trades had seen that the letter of aim was modified after it was distributed.

Both Shapeshift and Kraken who marked the letter expressed there were changes made to the first archive they had marked. The problem on hand was actually trying to call BTC Core protocol where the client is not having the longest chain in running the proof of work mostly.

Kraken clarified they would not like to be in a position to choose which anchor gets the opportunity to keep the BTC moniker. Shapeshift originator Erik Voorhees clarified his conclusion of the name issue on Twitter expressing:

Statement of Coinbase

On March 18 Coinbase organizer Brian Armstrong uncovered his supposition of the current emergency course of action letter and clarified why his organization did not take part.

"Coinbase didn't sign this letter since I think the aim behind it isn't right," Armstrong states. "At first glance, it is a correspondence about how trades would deal with the hard fork, and a demand to BU for replay assault insurance.

Be that as it may, my worry was that it was really a not at all subtle endeavor to keep the BTC moniker pegged to Core programming. I think various individuals who put their name on it didn't understand this."

Armstrong concurs that posting forked resources bodes well, however he doesn't trust the BTC name ought to naturally go to one advancement group. "On the off chance that there is overpowering backing from mineworkers and clients around any new form of the product (paying little respect to who composed it), then I surmise that will be called Bitcoin (or BTC)," says Armstrong. The Coinbase originator says the organization wishes to stay nonpartisan in the verbal confrontation.

Listing Pairs of Bitfinex

Also, one of the trades who partook in the letter, Bitfinex discharged its own particular posting arrangement called Chain Split Tokens (CST). Bitfinex clients will be permitted to theorize on the future occasions of a fork utilizing the CST tokens which incorporate BCC (Bitcoin Core) and BCU (Bitcoin Unlimited).

"Clients will have the capacity to make CSTs by "part" a bitcoin through the Token Manager (situated in the request sort drop-down menu of the sidebar arrange ticket)," Bitfinex clarifies on their site.

"When part, the BTC will be expelled from your record for each BCC, and BCU included. Through a similar Token Manager, you will have the capacity to turn around this procedure whenever, exchanging rise to quantities of BCC and BCU to remove BTC."

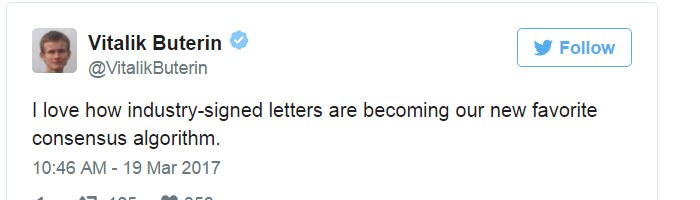

The discourse doesn't appear to be over to the extent the bitcoin name and marking is concerned. After the possibility letter, bitcoin advocate Olivier Janssens began a request of to motivate trades to stay impartial and not pick sides.

"Assigning Bitcoin Core as the default Bitcoin BTC/XBT is untimely, best case scenario and now a profoundly political choice," Janssens request of clarifies. There are many bitcoin supporters who concur with Voorhees, Janssens, and Armstrong's feelings concerning the longest bind getting the privilege to the BTC name, the same number of them have alluded to this quote offered by Satoshi in the bitcoin white paper;

Community Topic Continuation

During press time BU or Bitcoin Unlimited has approximately 35 % of mining bolster so despite everything it might be a while before any guessed split occasion happens. It's sheltered to state starting at right now nobody can foresee who will legitimately guarantee the BTC name and marking, particularly with a letter of plan that is debated by other surely understood exchanges.