Purchasing Litecoin

Most have, on more than one occasion, treated litecoin like silver to the gold of bitcoin. By market cap, Litecoin is the third biggest digital currency following Bitcoin, whereas Ripple claims the second place.

To undertake some of virtual money’s observed issues, Litecoin was created to serve as another option for Bitcoin. Compared to Bitcoin, Litecoin was architectured to be ‘lightweight’ and more plentiful. Moreover, as proof-of-work algorithm, it uses scrypt which was intended to let Litecoin be impenetrable to AISC mining, even though numerous companies state their intentions to institute scrypt AISC miners in the years to come.

On the network, a sum of 84 million litecoins can be created (against 21 million BTC), which was architectured to develop swifter blocks compared to Bitcoin. Should you have any interest in knowing a tad more regarding Litecoin, take time reading this thorough crash course on how to get on your feet.

A few tips prior to buying litecoin:

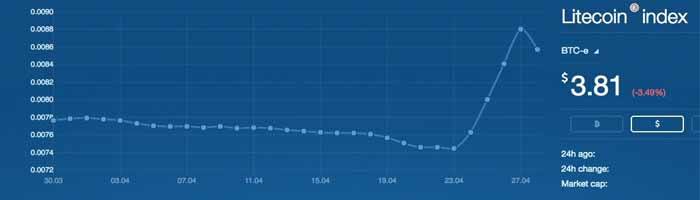

Subsequent to the cost rush of Bitcoin in November 2013, Litecoin became a rising lure for theorists however costs have fell in parallel since. You can anticipate both Litecoin and Bitcoin costs to enormously flow in a similar route, albeit the worth of litecoin is, without a doubt, lower compared to Bitcoin.

Investors of Bitcoin who are experience need not worry adjusting to litecoin, however, rookie investors may have difficulty treating it as simple, for compared to bitcoin, the framework is authenticated.

Another means of obtaining litecoins is through mining with the utilization of classic equipment for computing.

Constantly do your part in studying prior to investing money, as well as avoid compromising funds you cannot bear to waste.

Provided that you know the dangers, granted that you’ve researched on your own, yet you are nevertheless eager to embark on the Litecoin market, there exists a handful of probable hazards and problems that need be undertaken.

Fiat money for litecoins or bitcoins in exchange for litecoins?

Purchasing litecoins ain’t as easy as purchasing bitcoins, however this is no longer considered news given the less-established framework of Litecoin. One straightforward means of purchasing Litecoins is to plainly buy them using Bitcoins – this way is likewise the quickest and to most users, this is the most frugal choice.

Whoever owns a hoard of bitcoins can simply utilize them to buy litecoins on several exchanges:

- Cryptsy

- Kraken

- BTC-e

- Among those listed on the Litecoin Wiki.

One of many large-scale problems litecoin is involved in right now is the deficiency of exchanges eager to participate in it.

More or less, there exists two dozen exchanges of litecoin, however, not all but most solely grant BTC/LTC conversions, making the process of purchasing inconvenient.

Kraken, BTC-E, Crypto-Trafe and Bitfinex market litecoins for dollars, roubles, and euros but availability relies on your area. To illustrate, British investors have the ability to purchase Litecoins straight from BitBargain and Bittylicious with a private banking transfer, although such is not the situation in most nations. At Coinspot, Australians are able to transform from and to AUD.

Litcoins can be purchased using fiat money with the following exchanges:

- Kraken

- BitBargain UK

- Bittlylicious UK

- Bitfinex

- BTC-e

You shall assume the most direct means to buy is to purchase Litecoin through fiat wire transfer with the use of an exchange, although this tends to be a dreary operation for several reasons. Some important bitcoin exchanges such as Coinbase and BTC China do not manage litecoin exchanges currently.

The most undeniable benefit of buying litecoin with the use of Bitcoin is speed. In a sense, it should only last minutes, when in fact worldwide wire transfers usually take up more than one day to clean and probably acquire further fees. The restricted amount of litecoin exchanges indicates that the far-flung majority of promising investors have to depend on worldwide transfers.

Another way is to locally purchase Bitcoin, giving up the trouble of transferring money overseas, and transforming it to Litecoin. The advantage would be you get to obtain your bitcoin earlier and potentially obtain a better charge in the event you convert it, with the condition that Litecoin’s worth consistently rises. The disadvantage, however, is that you potentially have to pay more for Bitcoin should you be restrained to the domestic market.

Possible Issues with Litecoin Wallet

A certain amount of exchanges provide litecoin wallets internet-wise, they are, however, barely fancy solutions. Numerous users opt to utilize the authorized Litecoin-Qt desktop client, however, it has its own ample amount of shortcomings, such as reported syncing problems. To safeguard your account, Electrum likewise has a provision (Windows/Linux/OS X) utilizing a security passphrase (also called ‘seed’) consisting of 12 words.

You have the option to start a litecoin paper wallet in cases of lifelong cold storage.

It is likewise attainable to obtain ‘paper wallet’ cards having credit card-quality, courtesy of Crypto Coin Wallet Cards, whilst some small-scale companies have been marketing tangible litecoins or coin holograms.