What Is Loopring?

Loopring provides traders, participants, and institutions with a decentralized, automated trade execution system that intelligently implements their trades across the world’s crypto exchanges, shielding them from counterparty risk and reducing their trading costs.

Loopring intermediates trust between blockchains and exchanges, allowing trading members to retain custody of their funds. For ERC20 tokens initially.

Loopring is a decentralized trade convention and a "mechanized execution framework" based on Ethereum that will enable its clients to exchange resources crosswise over trades. It isn't a decentralized trade. Or maybe, it encourages decentralized trading through ring-sharing and request coordinating.

Parcel of new popular expressions there to focus on, however we'll remove the buzz somewhat later. For the present moment, the vital thing to comprehend is that Loopring will pool all requests sent to its system and take care of these requests through the request books of numerous trades.

- Overview - Table of Contents

- What Is Loopring?

- Getting Started With Loopring

- How To Get A Loopring Wallet?

- Loopring Resources

- How To Buy Loopring?

- How To Earn Loopring?

- What Is Loopring Mining?

- Latest Loopring News

Decentralized and brought together trades alike will have the capacity to actualize Loopring, giving the trades access to cross blockchain and cross trade liquidity and giving speculators access to the best costs accessible on the more extensive market. In addition, Loopring is blockchain skeptic, implying that any stage that utilizations shrewd contracts (e.g., NEO, Ethereum, Qtum) can coordinate with Loopring.

Since we've gone over the rudiments, we should expand on this for a more point by point understanding.

Loopring is an open protocol for building decentralized exchanges. Loopring operates as a public set of smart contracts responsible for trade and settlement, with an o_-chain group of actors aggregating and communicating orders. The protocol is free, extensible, and serves as a standardized building block for decentralized applications (dApps) that incorporate exchange functionality. Its interoperable standards facilitate trustless, anonymous trading.

An important improvement over current decentralized exchange protocols is the ability for orders to be mix-and-matched with other, dissimilar orders, obviating the constraints of two-token trading pairs and drastically improving liquidity. Loopring also employs a unique and robust solution to prevent front-running: the unfair attempt to submit transactions into a block quicker than the original solution provider. Loopring is blockchain agnostic, and deployable on any blockchain with smart contract functionality.

Loopring is not a DEX, but a modular protocol for building DEXs on multiple blockchains. We disassemble the component parts of a traditional exchange and offer a set of public smart contracts and decentralized actors in its place. The roles in the network include wallets, relays, liquidity-sharing consortium blockchains, order book browsers, Ring-Miners, and asset tokenization services. Before defining each, we should first understand Loopring orders.

At its root, the Loopring protocol is a social protocol in the sense that it relies on coordination amongst members to operate e_ectively towards a goal. This is not dissimilar to cryptoeconomic protocols at large, and indeed, its usefulness is largely protected by the same mechanisms of coordination problems [20], grim trigger equilibrium, and bounded rationality.

To this end, LRx tokens are not only used to pay fees, but also to align the _nancial incentives of the various network participants. Such alignment is necessary for broad adoption of any protocol, but is particularly acute for exchange protocols, given that success rests largely on improving liquidity in a robust decentralized ecosystem. LRx tokens will be used to e_ectuate protocol updates through decentralized governance.

Smart contract updates will, in part, be governed by token holders to ensure continuity and safety, and to attenuate the risks of siphoned liquidity through incompatibility. Given that smart contracts cannot be altered once deployed, there is a risk that dApps or end users continue to interact with deprecated versions and preclude themselves from updated contracts. Upgradeability is crucial to the protocol's success as it must adapt to market demands and the underlying blockchains.

The Loopring protocol sets out to be a foundational layer for decentralized exchange. In so doing, it has profound repurcussions in how people exchange assets and value. Money, as an intermediate commodity, facilitates or replaces barter exchange and solves the double coincidence of wants problem, whereby two counterparties must desire each other's distinct good or service.

Similarly, Loopring protocol aims to dispense of our dependencies on coincidence of wants in trading pairs, by using ring matching to more easily consummate trades. This is meaningful for how society and markets exchange tokens, traditional assets, and beyond. Indeed, just as decentralized cryptocurrencies pose threat to a nation's control over money, a combinatorial protocol that can match traders (consumers/producers) at scale, is a theoretical threat to the concept of money itself.

Protocol benefits include:

- Off-chain order management and on-chain settlement means no sacrifice in performance for security.

- Greater liquidity due to ring-mining and order sharing.

- Dual Authoring solves the pernicious problem of front running faced by all DEXs and their users today.

- Free, public smart contracts enable any dApp to build or interact with the protocol.

- Standardization among operators allows for network effects and an improved end user experience.

- Network maintained with exibility in running order books and communicating.

- Reduced barriers to entry means lower costs for nodes joining the network and end users.

- Anonymous trading directly from user wallets.

Getting Started With Loopring

When utilizing Loopring, merchants never need to store reserves into a trade to start exchanging. Indeed, even with decentralized trades like Ether Delta, IDex, or Bitshares, you'd need to store your assets onto the stage, for the most part through an Ethereum savvy contract. In any case, with Loopring, subsidizes dependably stay in client wallets and are never bolted by orders.

This gives you finish self-rule over your assets while exchanging, enabling you to wipe out, trim, or increment a request before it is executed. You could even move stores from your wallet altogether in the wake of putting in a request, however this would influence your last request, as the convention's ring excavators would be cautioned to the wallet's adjust before coordinating requests.

Discussing ring mineworkers, how about we go over the life structures of a trade on Loopring's convention.

Loopring is an open source protocol, not a traditional, centralized exchange. Any entity under this protocol can participate in order matching.

There are two types of Loopring exchange services fees derived from the order matching system: transaction fee and “ring-matching cost saving” fee.

Features

Reduced Counterparty & Exchange Risk - Loopring does not require members to send tokens to exchanges for custody. Tokens always remain in their blockchain addresses during the whole transaction life cycle Members can even transfer their tokens around after orders are submitted - Loopring will automatically adjust trading amount at the initial price. Loopring protects members from threats such as exchange bankruptcies and DDOS.

Decentralized - Orders are automatically executed while trade’s funds remain under their control in a decentralized smart contract on the blockchain.

Order Sharing - Loopring mechanism allows to order break into small pieces, identifies the best exchanges and times to trade those pieces on, and applies game theoretic logic to optimize trading results. Loopring can also well protect trading from DDOS attack.

Ring-Matching - Loopring is a decentralized, automated trading intelligence interfaces between crypto exchanges and blockchains, using our balance sheet to enable users to realize liquidity many times greater than available directly in the market, by both generating liquidity within the platform and breaking orders into small pieces that are placed across all market venues simultaneously.

Cross-chain protocol - Loopring was designed to be blockchain agnostic. As long as a blockchain has smart-contract support, Loopring can be implemented, and all ERC20-like tokens on such a blockchain can be traded under Loopring.

One can never have enough decentralized arrangements available to one, and this is particularly valid in the digital currency world. Albeit every advanced cash are intended to be decentralized, the vast majority of us happily utilize unified stages to purchase, offer, and exchange this new type of cash. It is the opposite things ought to develop. Gratefully, a few changes are upcoming in such manner.

- Overview - Table of Contents

- What Is Loopring?

- Getting Started With Loopring

- How To Get A Loopring Wallet?

- Loopring Resources

- How To Buy Loopring?

- How To Earn Loopring?

- What Is Loopring Mining?

- Latest Loopring News

Loopring is a decentralized trade and open convention which may proclaim some intriguing changes for the cryptographic money segment. All the more particularly, the objective is to shield clients from counterparty dangers, perform decentralized programmed exchanges, and lessen the general cost of purchasing and offering digital currency. It has every one of the signs of a defining moment changer, despite the fact that it is still too soon to tell regardless of whether it is an attainable idea. Loopring expels a considerable measure of hazard factors by not driving clients to send tokens or monetary forms to an incorporated custodial substance.

Rather, all tokens will stay in their blockchain-based locations and under the control of clients themselves. Loopring will likewise consequently change the exchanging sum at the underlying cost, enabling clients to exchange tokens even in the wake of submitting orders. It is a fascinating idea which shows why decentralized exchanging arrangements are crucial to the digital money area. Additionally, with no brought together stage to assault, there will be no DDoS assaults or trade chapter 11 concerns.

Moreover, Loopring has some expertise all together sharing. All requests can be separated into littler pieces to recognize the best trade and perfect time to exchange each clump. The outcome is an enhanced exchanging result without the need to depend on one single stage. Considering that this convention can exchange over all crypto-token trades on the planet today, it will be quite intriguing to perceive how this arrangement performs in a constant situation.

Moreover, Loopring utilizes a method known as ring-coordinating. Its robotized exchanging knowledge is equipped for interfacing with different trades and blockchains. Therefore, the convention ought to never observe any significant liquidity issues at all. The convention is intended to produce liquidity inside the stage and spread out requests over numerous trades. Besides, the cross-chain part of Loopring makes everything the all the more engaging. All it needs is a blockchain with shrewd contract support to legitimately execute.

Everything considered, Loopring may have what it takes to make decentralized exchanging a reality for digital currency lovers. Despite the fact that it stays to be checked whether this will really happen, one needs to respect the thought in general. The whitepaper related with this idea contains significantly more important data on how Loopring will function and carry on. For the time being, however, it is hazy if and when any blockchains will incorporate this idea.

How To Get A Loopring Wallet?

Loopr Wallet

We introduce you, Loopr, our wallet that has been integrated with our protocol 1.0.0 deployment on Ethereum mainnet.

The three most important components for Loopring ecosystem are:

1. the Loopring Protocol smart-contracts

2. relays that manage order pools and mine order-rings

3. wallets that can help users to manage their assets and orders

Loopr is a wallet developed by the Loopring Foundation, its very first version (beta1) had been implemented to verify the aforementioned components can indeed be integrated into a reliable solution. We are pleased to announce that beta1 is now available for invitation only testing at https://loopring.io. As beta1 was not designed with an optimized user experience, we feel obligated to have this post to introduce you to a trustless and decentralized ERC20 token trading experience.

If you don’t like the way Loopr works, no worries — a beta2 version is currently being designed to provide a much better user experience for normal users.

Popular Wallet Operations

We will cover the following user interactions:

- Browse markets

- Generate and unlock your wallet

- ETH/WETH conversions

- Authorize for allowance

- Submit orders

- Browse trades and orders

- Browse order-rings

- Cancel an order

- Cancel all orders

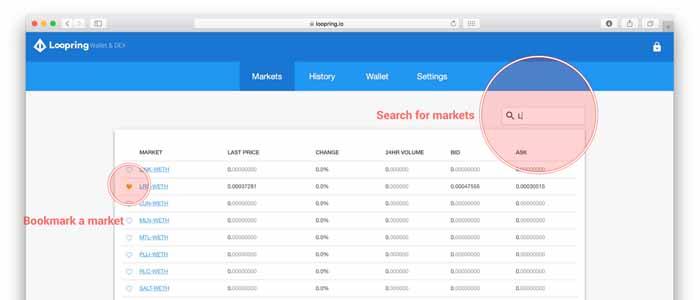

Browse markets

You can go to https://loopring.io/#/markets for a list of all (over 60) markets that Loopr currently supports. In the future, we’ll support most ERC20 token to ETH markets and even any-to-any markets. To quickly search for a market, we suggest you to take advantage of the search box on the top-right corner, then bookmark the search results if you’ll revisit some of those market later.

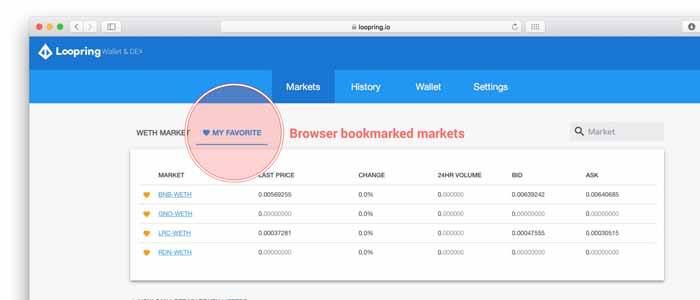

Once markets are bookmarked, they will show up under the “My Favorite” tab (you need to clear the search box first, this is something we need to fix in beta2).

You will notice that most tokens are traded with WETH. WETH stands for “Wrapped ETH”, it is also known as “Ether Token”.

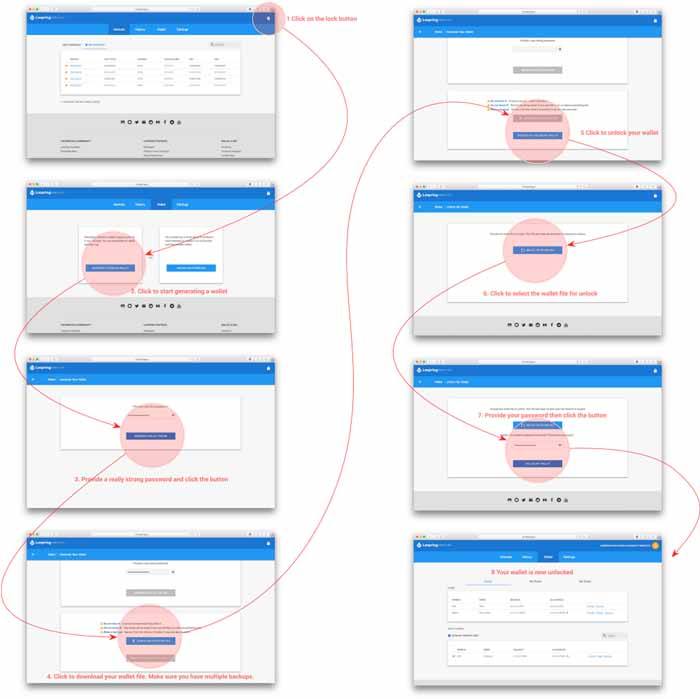

Generate and unlock your wallet

To generate and unlock your wallet, you can follow the following workflow. If you have a keystore file already, you can click on “Unlock Keystore File” in the second step.

One thing to keep in mind: Loopr does NOT have a backend database to store your wallets or private keys. If you lose your keystore file or forget your password, you’ll lose access to all of your tokens and Ether. There is NO way we can help you to recover. We always suggest you to backup your wallet (keystore) files and make sure you remember the passwords BEFORE storing any value in the newly generated wallets.

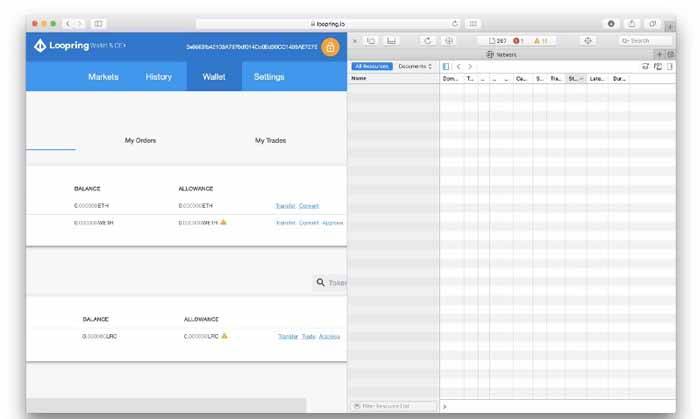

Loopr will NEVER send your private keys over the network to anyone. To make sure of it, you can check out our source code at https://github.com/Loopring/loopr, or you can open browser’s development console, then open a zero-balanced wallet to verify our claim (as shown in the following image).

Several sections that follow assume you have certain ETH and LRC in your unlocked wallets.

ETH/WETH conversions

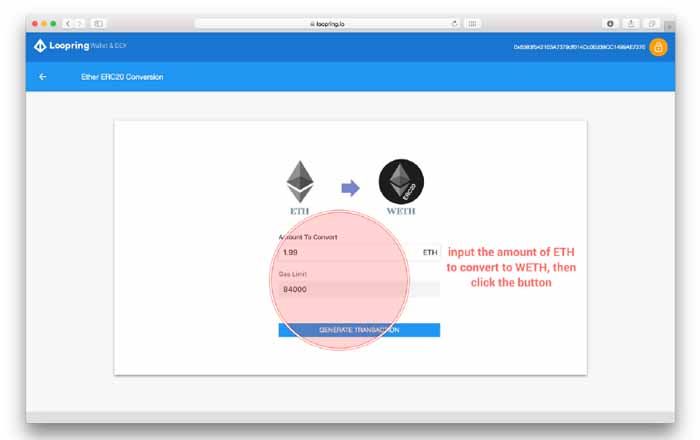

The Loopring Protocol can facilitate trading between ERC20 tokens. Loopr needs to convert Ether to Ether Token for trading as Ether is not ERC20 compatible, but Ether Token is. Converting between Ether and Ether Token will be done for you automatically when you submit an order, but if you want to trade frequently, we strongly suggest you to convert some Ether to Ether Token beforehand manually; otherwise each order will take one more blockchain transaction just for the ETH-WETH conversion which takes time and gas.

Conversions between ETH and WETH are done on-chain through Ethereum transactions. ETH and WETH are always converted 1:1 which is guaranteed by the WETH smart contract. The WETH smart contract also guarantees the total WETH issued is exactly the total ETH deposited. In other words, ETH and WETH is equiviate in value, and WETH is just the ERC20 form of ETH.

Now let me show you how to convert ETH to WETH. Converting WETH back to ETH is similar.

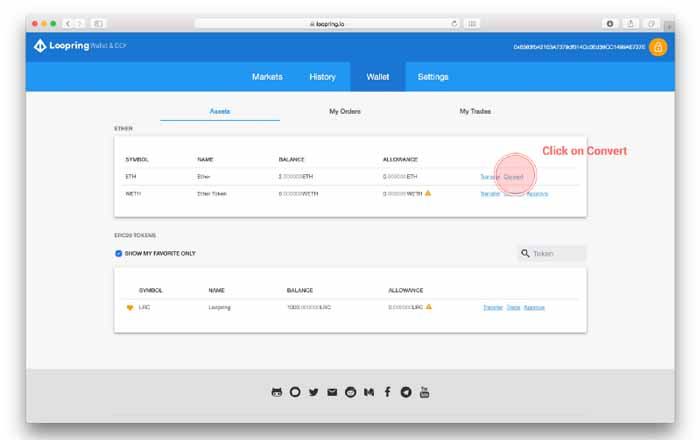

First you need to click on “Convert” button in the same row as ETH,

Then input the amount of ETH you want to conver to WETH. You can only convert up to the amount of ETH you have minus some transaction fee. Then click the button to generate an transaction.

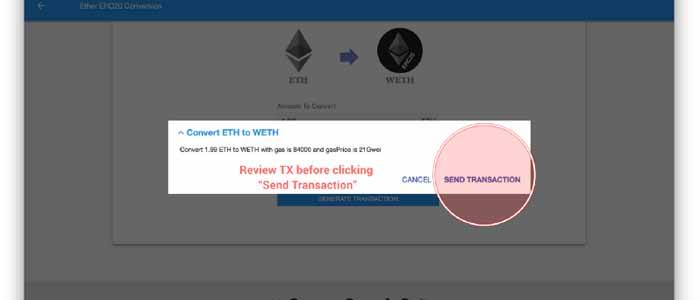

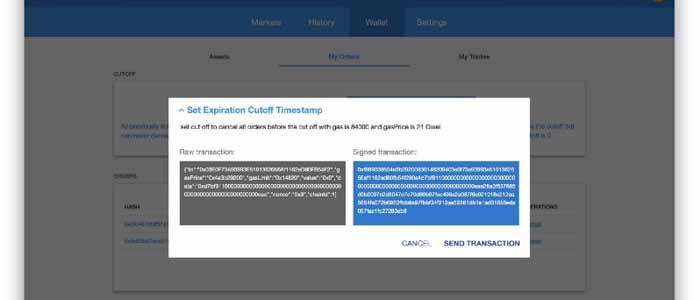

A dialog will pop up for you to review the transaction (both raw and signed), you can click on “Convert ETH to WETH” to toggle the display of details. Again, Loopr’s source code is available for you to review. If all look OK, you can click on “Send Transaction” button. You’ll see a confirmation message (with green background) telling you the transaction has been sent to Ethereum mainnet. You can click the transaction’s URL in the message to monitor transaction progress on https://etherscan.io.

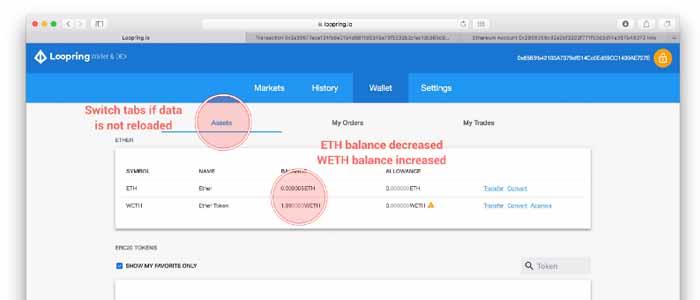

Once the transaction is mined into an Ethereum block, you can check your balance of both ETH and WETH. (Tip: to reload balances, you can switch the secondary tabs.)

Again, converting between ETH and WETH is done on-chain using smart-contract, therefore conversions are secure and trustless. If you do a lot of trading, convert a big portion of your ETH to WETH to avoid unnecessary small conversion transactions.

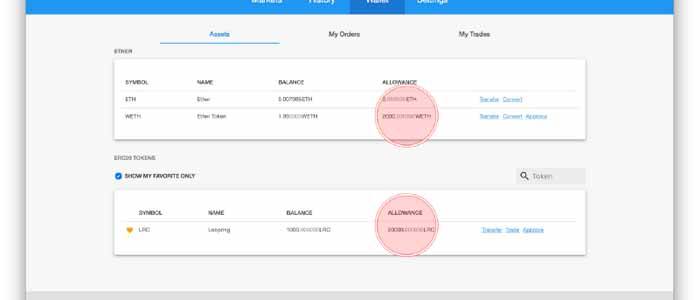

Authorize for allowance

To submit orders, you need to authorize the Loopring Protocol for settlement. Let say you want to buy LRC using WETH (which is the same as “selling WETH for LRC”), you need to authorize the protocol an WETH allowance up to the total amount you would like to sell in the near future.

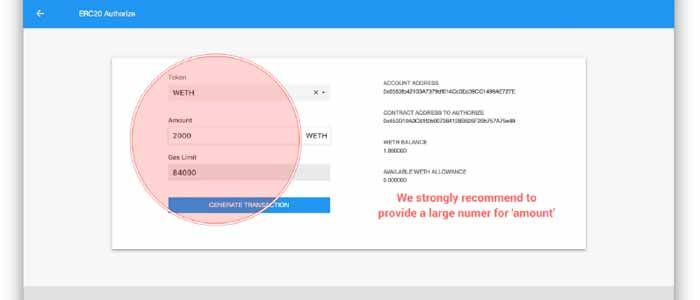

In this example, I’ll authorize the protocol with 2000 WETH allowance. Note that we only have 1.99 in my wallet. Allowance can be as large as possible regardless the real balance. As a matter of fact, we encourage you to set an allowance of a really big number (for example 1,000,000,000) just in case you want to use Loopring Protocol for trading more. Given that our protocol is open-sourced and has been carefully reviewed. Allowance is considered secure, you don’t need to worry.

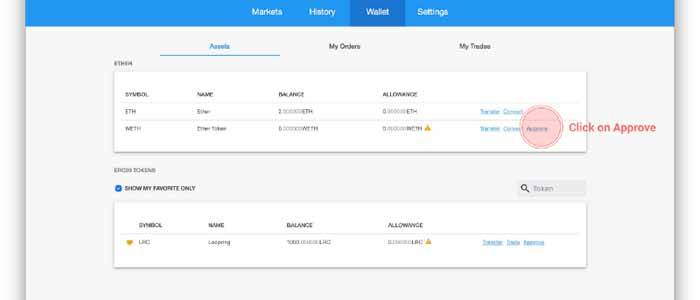

First you need to click the “Approve” button for the token you want to authorize, in our case, this is WETH.

Then, put “2000” as the amount of allowance. Again, in real world usage, we strongly recommend to give this a very large number. Then click “Generate Transaction”.

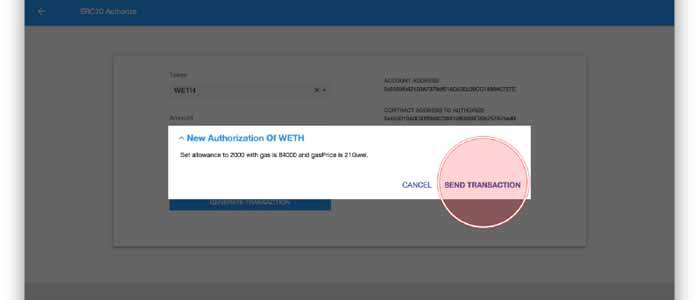

Again, review your transaction then click on “Send Transaction”.

Please also follow the same procedure to set up a 20000 LRC allowance. Then you should see something like this:

Now you can submit orders.

Submit orders

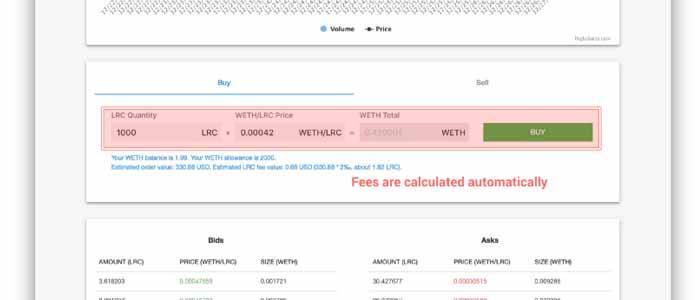

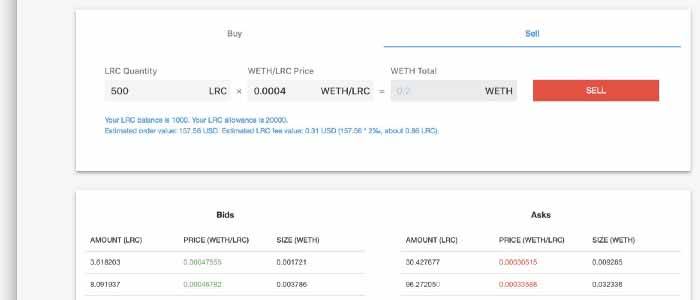

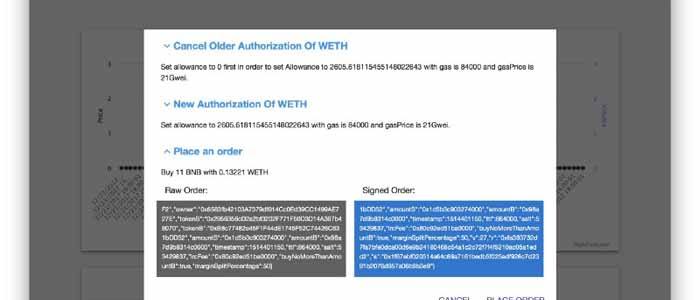

We will show you how to submit an order to buy 1000LRC at the price of 0.00042ETH/LRC, then submit an order to sell 500LRC at a lower price of 0.00040ETH/LRC, the miner should mine them into a ring.

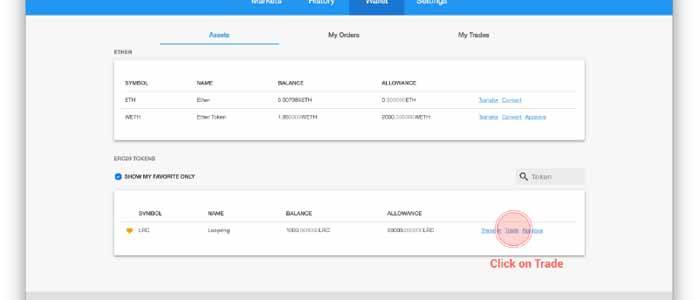

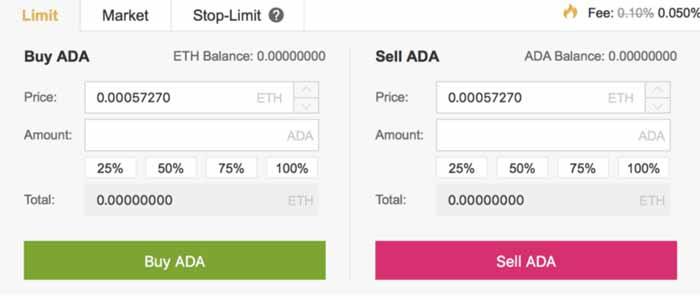

To start trading, click on the “Trade” button from inside of the “Assets” page, or you can navigate to a market of your interest through the “Markets” top page.

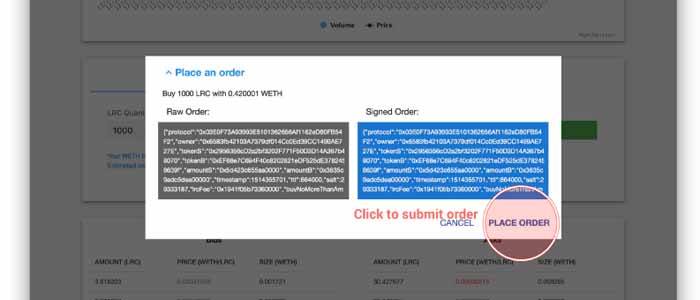

In the market, you can use the form to submit a buy order as illustrated in the image below:

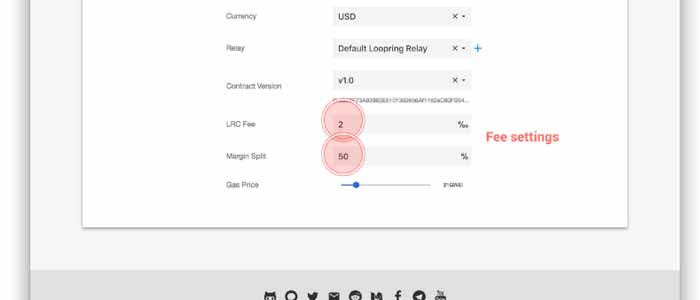

Notice that LRC fees are calculated automatically based on your settings. By default, if your order’s estimated fiat value is X, you’ll pay (X * 0.2%) worth of LRC as trading fee. You will by default also pay 50% margin-split if miner choose to take margin-split instead of LRC as mining fee. You can change these settings in the “Settings” page:

In most cases, we don’t recommend you to change these settings. Lowering LRC trading fee or margin-split will slow down or even disable your orders being fulfilled. To speed up trading, we strongly recommend you have some LRC in your wallet and set up LRC allowance. If you want to learn more about the fee model of the Loopring Protocol, please take a look at this blog.

Once you have specified your order parameters, click on “Buy” then you’ll see a dialog popping up for you to confirm the action before signing the order.

Order submission will not involve Ethereum transaction, instead, orders will be broadcast the our off-chain relay network for ring-matching.

Let us submit the sell order as follows:

After about then seconds, you’ll see these orders are mined into a ring. If you repeat my operations, it’s possible that your first order will be mined into a ring with someone else’s order.

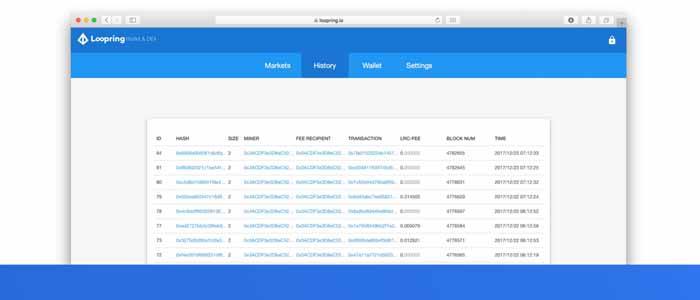

Browse trades and orders

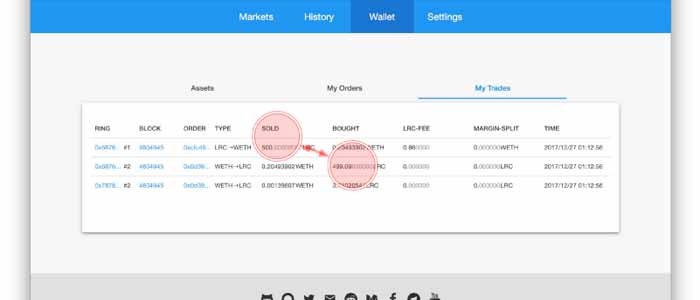

Click on “My Trades” to see the list of your recent trades. Since all Loopring trades are settled on-chain, sometimes a wallet (Loopr included) may suffer from network delays. Loopring is not designed for realtime or high-frequency trading. You would have to fall back to a centralized exchange for that kind of trading activities.

In the image above you can see two trades, this is because we submit a buy order and a sell order using the same address. We won’t explain the math behind the scene, but apparently the miner chose LRC fee instead of margin-split. Currently Loopr doesn’t display trading price but it will in beta2.

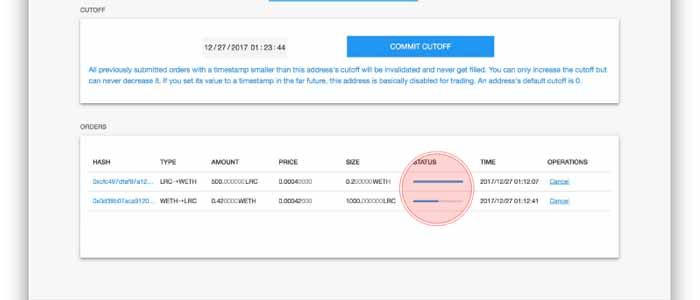

If you click on “My Orders”, you will see the two orders, one is fully filled and the second one is partially filled.

Browse order-rings

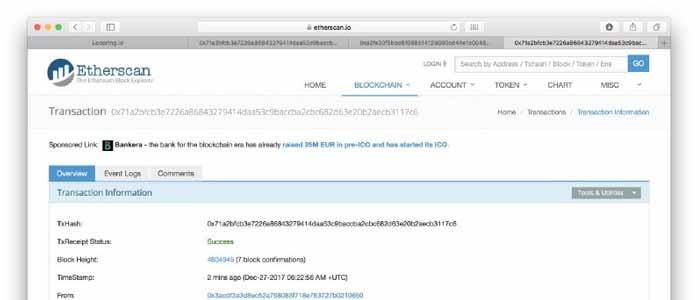

You can browse the entire list of Loopring (v1.0.0) rings on etherscan.io:

https://etherscan.io/address/ringmatch.eth

The ring containing our 2 orders is available at:

https://etherscan.io/tx/0x71a2bfcb3e7226a86843279414daa53c9baccba2cbc682d63e20b2aecb3117c6

This is not a typical ring as our address is trading with itself (therefore some internal self-to-self transactions are avoided) A typical ring will involves several small internal transactions (for a ring of N ,up to 3*N internal transactions).

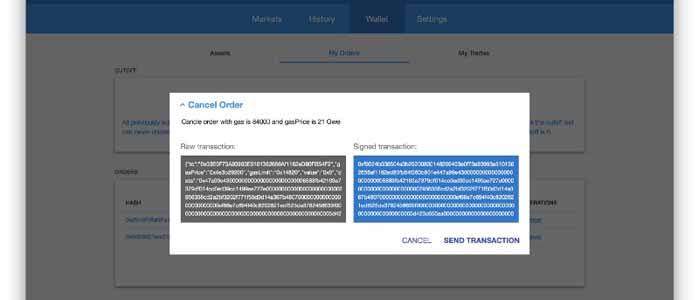

Cancel an order

Cancelling an order takes an Ethereum transaction. This should be avoided by all means, and it can be done by specifying a short time-to-live (TTL) for your orders. In other words, if you specify 30 seconds as the TTL for your orders, then if they haven’t been mined into rings within 30 seconds, these orders expire automatically (which is guaranteed by the Loopring smart contract). Currently Loopr doesn’t provide UI to specify TTL, but we’ll soon add such functionality to beta1.

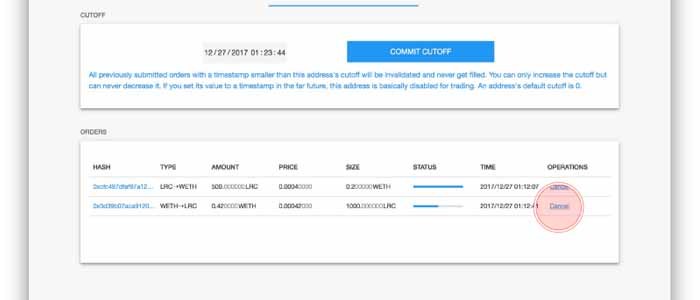

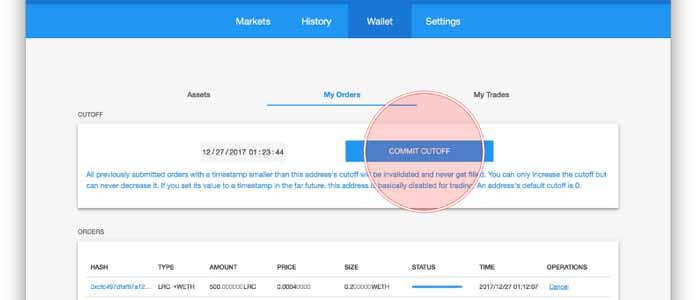

Cancel all orders

You can cancel all pending orders with one Ethereum transaction. Technically we call this a “cutoff”. In Loopr you will find a “Commit Cutoff” button. It will be renamed to “Cancel all my orders” or something like that. You can also ignore the date time selector on it’s left for now (it will become a readonly timestamp indicating when you conducted the last cancel-all action).

Smart Actions

Loopr has a feature called “smarter actions”. It helps users generate prerequisite transactions required for an order to be submitted.

For example, if my allowance of WETH is insufficient for my new order, Loopr will automatically generate two transactions, one for resetting the allowance and one for setting up the new allowance to match my order’s spending.

Loopring Resources

How To Buy Loopring?

Loopring is an open, multilateral token exchange protocol for decentralized exchange on the Ethereum blockchain. Loopring is intended to serve as a common building block with open standards, driving interoperability among decentralized applications (DAPPs) that incorporate exchange functionality. Trades are executed by a system of Ethereum smart contracts that are publicly accessible, free to use, and that any dApp can hook into. Loopring’s token is based on the ERC20 Ethereum Token Standard and can be liquidated through a Loopring smart contract.

- Overview - Table of Contents

- What Is Loopring?

- Getting Started With Loopring

- How To Get A Loopring Wallet?

- Loopring Resources

- How To Buy Loopring?

- How To Earn Loopring?

- What Is Loopring Mining?

- Latest Loopring News

Step 1: Create an account on Binance

The first step in the process is to create your Binance account. The process is very simple. You are only required to provide your valid email address and a password. Make sure that you provide a strong password when creating your account, since this is a place where you will be keeping your funds. You can also provide a referral id. You can use my referral id if you’d like (13780719).

Step 2: Activate your Account

Once you finish with the first step, an email will be sent to you from Binance to activate your account. Open your email client and click on the activation link. If you can’t find the activation email from Binance then check your spam folder or request Binance to send another activation email.

Please note that they may ask you for some verification documents such as national id, driving license and/or passport.

Step 3: Log in to your Account

Go back to Binance website and log in to your account with the credential you provided in the previous step. Although it is not mandatory, the first thing that I would personally do is to set up a Two-factor Authentication in order to strengthen the security of the account.

Step 4: Transfer Funds to your Binance wallet

In Binance you buy Loopring (LRC) tokens only by using Ethereum or Bitcoin. Therefore, you will need to transfer some Ethereum or Bitcoin to you Binance wallet. In case, you do not have any Bitcoin on Ethereum, then you can buy some using fiat currency at Coinbase or your preferred exchange. If you don’t know how to do that, then you can just follow one of our step-by-step guides on how to buy Ethereum or Bitcoin.

In order to deposit your funds, tap on the Funds tab on the top navigation bar. Then click Deposit Withdrawals and from the list below find either the Ethereum or Bitcoin wallet, depending on what you want to deposit. Select the wallet address provided and use it in the exchange or wallet you have your funds and send them in Binance.

Step 5: Buy Loopring (LRC) tokens

Congratulations, you are ready to buy some Loopring (LRC) tokens. Tap on the Exchange tab and then Basic on the top navigation bar. On the top right of the exchange select BTC (Bitcoin) or ETH (Ethereum) and search for LRC/ETH or LRC/BTC.

This will open the trading view of the pair you want to exchange. Go and find the Buy/Sell section of the page and place your Buy order. Here you go, you have your first Loopring (LRC) tokens.

Latest Loopring News

Optimization Bounty for Loopring Smart Contracts on Ethereum

Use your skill and experience to win up to 500K LRC. This bounty program is designed to optimize Loopring Protocol smart contract to reduce gas consumption.

Loopring Protocol Smart Contracts - The Loopring project is a protocol for decentralized token exchange. We have deployed v1.3 on Ethereum mainnet. This set of smart contracts include the following files:

- LoopringProtocol.sol: An interface for describing the protocol’s functionality.

- LoopringProtocolImpl.sol: The protocol implementation that encapsulates most of the core logics. This file demands a great deal of review and auditing.

- TokenRegistry.sol: This smart contract whitelists ERC20 tokens supported by Loopring protocol. Loopring will only support tokens with verified source code.

- NameRegistry.sol: This smart contract allows ring-miners and wallets to register so the can use a smaller id instead of addresses in ring settlement transactions.

- TokenTransferDelegate.sol: A smart contract to transfer tokens on behalf of different versions of the Loopring protocol meant avoid re-authorization after a protocol upgrade/migration.