What Is Populous?

Bitcoin might be the first to utilize blockchain innovation, however nowadays nearly everything can profit by fusing the stage into its reality. The most recent development to consolidate blockchain stage is Populous, the first and final ethereum based stage particularly intended to take into account receipt and exchange back.

- Overview - Table of Contents

- What Is Populous?

- Getting Started With Populous

- How To Get A Populous Wallet?

- Populous Resources

- How To Buy Populous?

- How To Earn Populous?

- What Is Populous Mining?

- Latest Populous News

Not just doe it utilize shrewd contracts, Populous uses XBRL information too pegged tokens with a specific end goal to make an exceptional exchanging condition for both the speculators and the receipt dealers when they exchange countless solicitations from all parts of the world utilizing its blockchain innovation.

Information has constantly held such a noteworthy part with regards to settling on a budgetary choice. This is the place Populous sees the need to add blockchain to it's framework, in light of the fact that not exclusively does the innovation makes it workable for us to enlist any of our money related exchange and store it safely, it likewise ensures that the greater part of the benefits which are enrolled and put away by the clients can be allowed straightforwardness and clients can be given the sufficient rights to security.

With this blockchain innovation, the majority of the put away information can likewise be shared consistently and secretly when it is completely required – commonly when one needs to guarantee their own particular protection.

The greater part of the previously mentioned focuses may appear to be unfathomable, however to the individuals who have constrained comprehension on what Populous brings to the table and how it can profit them, a more exhaustive clarification is required – and what better approach to comprehend the blockchain based application other than perusing a dependable audit?

Much the same as some other entrepreneur, I found that applying for an advance for business designs is a long way from a perfect arrangement. Particularly if your business requires a type of prompt financing.

We as a whole have been there, the sudden increment in working capital financing or spontaneous here and now venture incited us to make quick move through subsidizing – this does not just achievable generally, regardless of the possibility that we can get the subsidizing we require, we may need to locate a weighty cost therefore.

As opposed to deciding on business advance, for what reason not gather the cash owed to your independent venture? This is precisely what Populous is really going after. By embracing the idea of customary receipt supplier, Populous encourages you figure out how to get the cash owed to your business instantly – rather than sitting tight for 45 days which regularly wind up causing money related hardships.

Getting Started With Populous

Populous is a global P2P (peer-to-peer) invoice discounting platform built on Blockchain technology. We combine the trust, transparency, security, and speed of Blockchain with our proprietary smart contracts to directly pair invoice sellers and lenders to transact directly and without third parties.

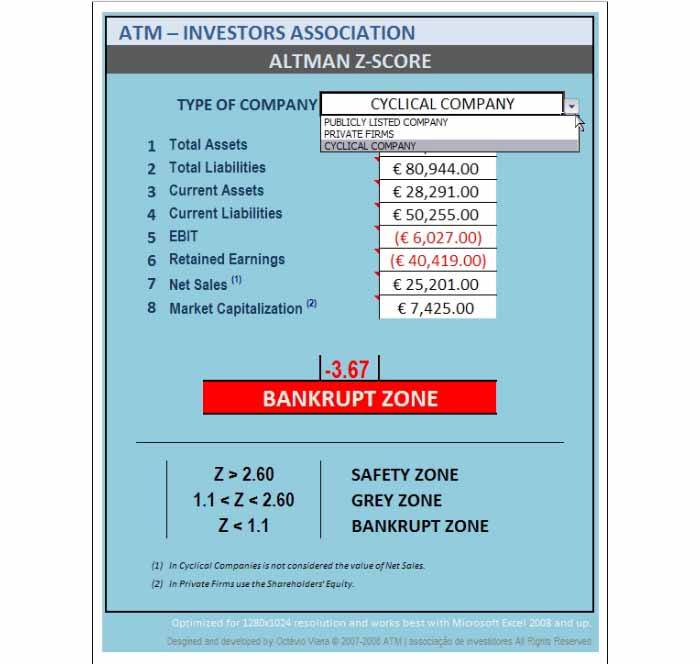

Our proprietary smart contracts reduce risk by utilizing XBRL data, Altman Z-scores, and other data to ensure the strong financial credit worthiness of businesses that want to sell invoices.

Why Blockchain?

Blockchain technology opens the doors for everyone to participate in an alternative finance marketplace. In the past, financing was only available through banks and financial institutions which have high fees and other barriers to entry.

Blockchain financial technology opens the marketplace for all investors and all invoice sellers to work together for mutual benefit by removing these barriers.

Perhaps the largest barrier to entry for both invoice sellers and investors is the geographic limitation in the current model. By using the fiat-pegged Poken cryptocurrency on our platform, invoice investors and invoice sellers can work together globally.

For example: an investor from China or Japan can freely invest in invoices sold by UK businesses and vice versa. The Poken creates a stable trading environment by being pegged to virtually any given currency and is Ethereum ERC20 compliant.

Banks and other financial institutions have attempted to create alternative financial platforms on the blockchain, but these platforms are limited by banking and finance industry regulation. Populous will replace this legacy platform because we are not limited by these regulations.

Block chain technology eliminates the inefficiencies and risks of manual contract origin and processing, associated manual errors, and duplication of invoice financing. This makes value propositions such as micropayments more feasible.

- Overview - Table of Contents

- What Is Populous?

- Getting Started With Populous

- How To Get A Populous Wallet?

- Populous Resources

- How To Buy Populous?

- How To Earn Populous?

- What Is Populous Mining?

- Latest Populous News

For example, when a smart contract is executed between an invoice buyer and a invoice seller, 80% of the funds will be released to the invoice seller via the smart contract. Payment is only confirmed when the transaction is entered into the distributed ledger and the crowd-funding process is then closed. All legal requirements are written into the smart contract which are legally binding when executed.

The smart contract prevents fraud since the smart contract will not allow invoices that have already been financed to receive duplicate financing. Therefore, a smart contract acts as a built-in protective layer on a Blockchain ledger.

Blockchain technology is the future as it enable more efficiencies to be built-in such as decreasing the requirement to manually process and initiate contracts, reduces risk through the elimination of manual errors and duplication of invoice financing which could make value propositions such as micropayments more feasible.

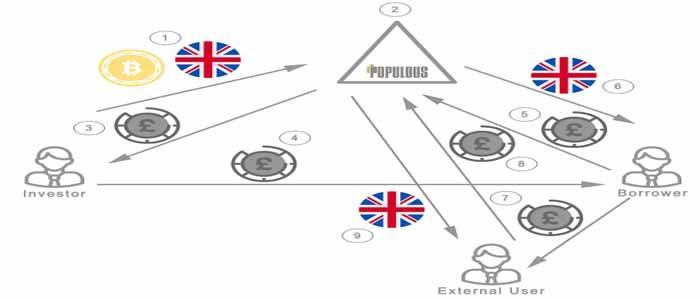

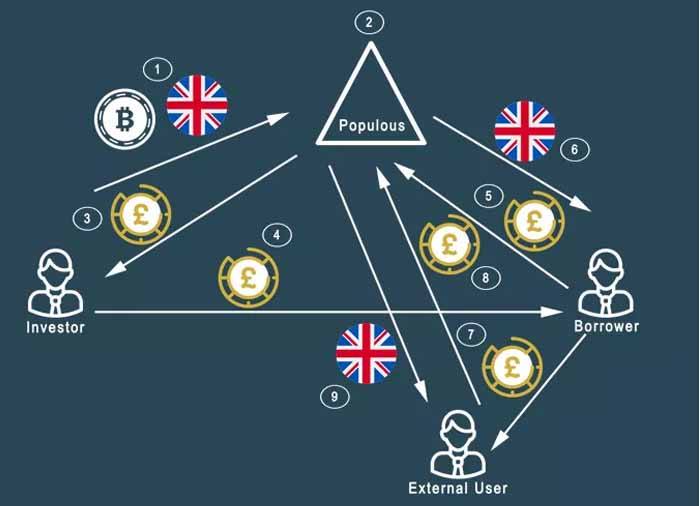

The flow of funds within the platform are made possible through the use of custom stable currency tokens called Pokens. Pokens are pegged 1:1 with the national government currencies involved in a given transaction. For example: £8 GBP are represented by 8 Pokens (GBP). All financial transactions between invoice buyers and sellers will be executed via Pokens.

Since Pokens are ERC20 compliant, they allow us to take full advantage of the smart contracts on the Ethereum Blockchain. The use of the custom stable Pokens shields the invoice buyers and sellers from market volatility. They also allow us to support currencies from any part of the world without the need of third parties.

Populous is a blockchain technology platform that lets you sell your invoices online and take control of your cash flow. The company is rebuilding invoice and trade finance using their blockchain technology.

Found online at Populous.co, the platform is a mix between blockchain and invoice finance. It relies on blockchain technologies like XBRL, smart contracts, Stable tokens, and more to create a unique trading environment for investors and invoice sellers worldwide.

Using Populous, companies can sell invoices quickly, then redeem their Populous digital tokens for real-world fiat currencies. They can do this in a cheaper, faster, and more transparent way than what is currently available through conventional invoice marketplaces.

The overall goal of Populous is to make a new, next-generation financial marketplace. To date, Populous is the first and only invoice and trade finance platform on the Ethereum blockchain. It allows you to buy and sell invoices globally.

The ecosystem is based around the use of Populous’s custom tokens called Pokens, which are pegged 1 to 1 with fiat currencies around the world. The value of Pokens is backed by investors who deposit funds on the platform to finance invoices.

You can sell your invoice for Pokens, then redeem those Pokens for currencies in the real world. It’s just like selling an invoice through an ordinary marketplace, but with cheaper transaction fees and faster processing thanks to blockchain technology.

How Does Populous Work?

Populous is based around the distribution of Pokens.

Once invoices are financed by investors, Pokens are sent to invoice sellers (also known as borrowers). Pokens can be exchanged for fiat currency or transferred to an external Ethereum wallet.

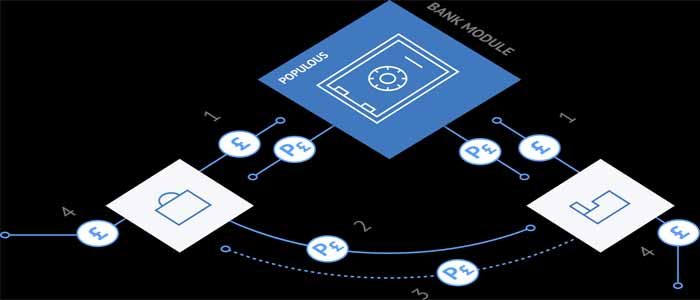

Pokens work in two different ways: inside and outside the platform. Inside the platform, Populous manages an internal ledger with the balances of each borrower’s and investor’s accounts for each currency. Outside the platform, Populous offers a publicly accessible smart contract for each token.

The tokens are based on the ERC20 token standard. The Populous blockchain itself is a combination of the Ethereum and RSK blockchains. Other technologies in use with Populous include XBRL, the Z Score formula, Smart contracts, Stable tokens, and others.

You can view more detailed technical information about Populous at the company’s whitepaper here.

How to Use Populous

There are three main parties in the Populous ecosystem, including the Administrator, Borrower, and Investor. The administrator approves and manages clients’ accounts and actions. The borrower sells invoices on the platform (Clients can register as borrowers when they want to sell invoices). And the Investor bids on auctioned invoices (clients can register as invoices when they want to buy invoices).

These three parties interact with the core three technologies of the Populous system, including:

Bank:

The bank manages the internal ledger for all platform accounts, including the connections between the internal ledger and the external tokens.

Auction:

The auction platform manages auction operations. Administrators can create auctions based on data provided by borrowers. Investors can create investor groups through the auction platform, or make bids on auctions. The auction module is logically connected to the IPFS distributed web. In other words, every invoice auction has hash references to related documents uploaded on the IPFS web.

External Tokens:

Every worldwide government currency which is supported by the platform has a corresponding smart contract. These external tokens are based on the ERC20 token standard. Clients can withdraw their funds outside the platform using these smart contracts, allowing them to gain sovereign access to their tokens.

Who Should Use Populous?

Ultimately, Populous is for three groups of people:

People who are tired of waiting for customers to pay their invoices. People who wish to upload invoices and have them paid within 24 hours Anyone who wants to gain fast access to cash by selling an invoice as soon as possible.

The invoice selling industry is thriving on the internet. Populous just wants to introduce blockchain technology to the invoice marketplace, facilitating faster, easier, and cheaper international transactions in a transparent, decentralized marketplace.

How To Get A Populous Wallet?

New fintech startup Populous is introducing smart contracts, blockchain technology and digital tokens to the invoice financing space.

Having raised more than US$10mn in crowdfunding in just five days, the company has now started piloting its new platform, which lets firms and individuals sell or buy invoices globally.

The early support has been overwhelming, Populous’ founder and CEO Stephen Williams tells GTR. “We’ve been getting a lot of interest from other invoice factoring firms and financial firms that are not on the blockchain, wanting to join the project, including banks as well,” he says.

The platform is much like a conventional invoice marketplace, but the underlying blockchain technology brings a range of advantages, such as cheaper transaction fees, more efficient and faster processing, as well as improved transparency and security.

Williams says the startup aims to lower the barriers to entry for investors, allowing for far more accessibility to the invoice finance market. And with lower costs, it will bring increased liquidity to companies looking for financing.

Built on Ethereum, the platform takes advantage of smart contracts and a decentralised network, but none of its operations use or rely on cryptocurrencies like bitcoin or Ethereum’s value token ether, which are often described as volatile. Instead, it uses Populous’ custom stable tokens – called Pokens – being stable in that they are pegged with fiat currencies around the world (although they can also be bought with other cryptocurrencies).

- Overview - Table of Contents

- What Is Populous?

- Getting Started With Populous

- How To Get A Populous Wallet?

- Populous Resources

- How To Buy Populous?

- How To Earn Populous?

- What Is Populous Mining?

- Latest Populous News

“With the smart contract, we have created our own tokens, our own currency in a sense, which the contracts accept,” Williams says. “For example, a guy from India wants to finance an invoice from Sweden, so he would place his money into the platform, and it will get converted into kroner Pokens via the smart contract.”

When an auction is live, investors can bid on an invoice within a timeframe of 24 hours. Their tokens are held in the smart contract until the auction has concluded, after which the contract executes itself depending on the pre-defined criteria, and the invoice seller automatically receives his tokens. These can again be redeemed in any fiat or cryptocurrency.

The whole process, however, isn’t completely autonomous, as the platform administrator still needs to carry out know your customer checks, and approve and manage clients’ accounts and actions.

The use of stable digital tokens, Williams says, is more straightforward, quicker and cheaper than conventional methods, especially for cross-border activities.

“If you think about the complexity around different currencies and settlements and consolidation of payments, it’s a much more efficient strategy to use tokens, and it opens up the market to the rest of the world,” he explains.

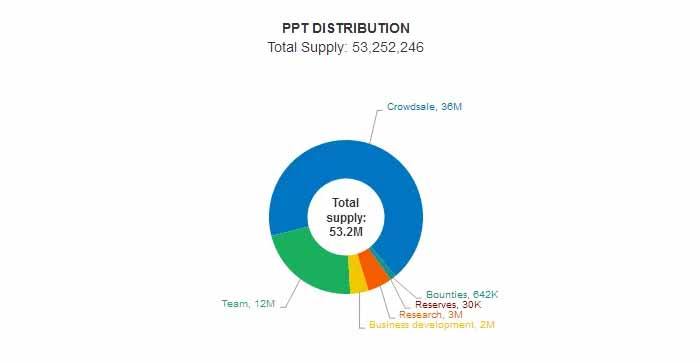

Initial coin offering

Having lined up clients, Populous started piloting its platform this week and will release the beta version in November, before going live in January next year.

The final steps were made possible after having received an unexpected level of support as the company was about to launch an initial coin offering (ICO).

An ICO is an alternative way for a startup to raise funds – as opposed to seeking investments from venture capitalists or banks – by issuing digital tokens. It is similar to an initial public offering (IPO) in that a stake of the company is sold to finance new projects, but in an ICO it is – like a crowdfunding process – open to any supporters keen to invest, and funds are typically raised in cryptocurrencies like bitcoin or ether.

Early backers are usually motivated by a prospective return on their investment, as a startup’s success would often translate into a higher token value.

In Populous’ example, US$10mn+ was raised in ether by issuing so-called platform tokens – these are different from Pokens and are classified more as an asset. While Populous had announced it would issue these asset tokens in an ICO on July 16, it never got that far. Having initiated a pre-ICO a week earlier – in which the token was first offered to a limited number of potential backers – Populous sold out after just five days.

Williams says most investors were high-net-worth-individuals, who were especially keen on the innovative approach to traditional invoice financing. “A lot of the people have not invested in cryptocurrencies before and haven’t participated in any ICO before,” he says.

Ultimately, the big beneficiaries are the invoice sellers, primarily SMEs around the world, who will soon have yet another way to improve their cash flow, now with blockchain and digital money.

I might want to begin off by saying, Populous is ostensibly extraordinary compared to other tasks to turn out from the blockchain space. In any case, that is my sentiment as I am Populous' author and CEO and I'm one-sided to state that.

Subsequent to perusing this article I trust you will concur with me and unmistakably observe the vision and the potential advantages the Populous Platform will convey to the eventual fate of back and the blockchain.

So who am I and how would I fit into this? All things considered, this is a decent inquiry and most likely an essential one, no doubt. I am Stephen Williams, basically call me Steve, a generally young fellow raised and brought up in a territory called Lewisham which is in South East London, UK.

My interest with information began at an early age when I would regularly think about how individuals manufactured huge organizations and wound up plainly fruitful.

That lead me to buy my first duplicate of the FT, I had no clue what I was perusing yet I was drawn by the figures introduced on the front page of the budgetary circumstances daily paper.

There I started perusing and concentrate each day on the money related soundness of organizations and how they worked and generally significantly how organization information assumed an essential part in the entire procedure of exchange back and credit choices.

It was not long after my self-examining I started to consider ways I could get in on the activity and at this point I discovered I had the aptitude to dissect information and its sources.

I would frequently fly out forward and backward to the city business library to get to organization money related data as the library had memberships with substantial information merchants and it was allowed to use as a part.

After numerous times of contemplating and obtaining the essential information that I expected to begin my first business, I was conveyed a difficulty when I was not ready to push ahead with my arrangement since I didn't have enough understanding and capital required at the time.

So I chose to plunge further and more profound into investigating more about budgetary information. It wasn't long after at that point, that eXtensible Business Reporting Language 'XBRL' was supplanting the path in which organizations needed to document their yearly records to the Companies House.

I began to play close regard for progressing advancements as they unfurled and at that point I had started programming and creating programming I saw an open door introducing itself to me.

- Overview - Table of Contents

- What Is Populous?

- Getting Started With Populous

- How To Get A Populous Wallet?

- Populous Resources

- How To Buy Populous?

- How To Earn Populous?

- What Is Populous Mining?

- Latest Populous News

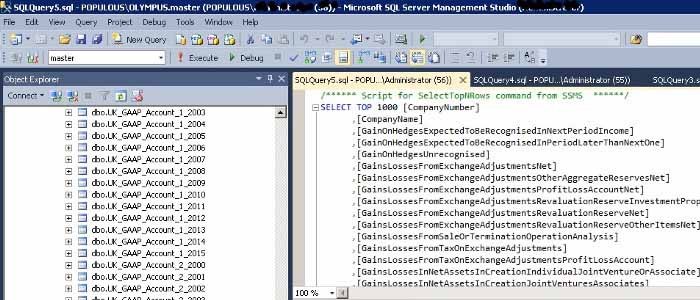

Presently XBRL is similar to XML and I knew how to extricate information from XML, so when the Companies House reported that it would now give masses and greater part of XBRL organization bookkeeping information out for nothing to general society, this was an easy decision and I in a split second knew the essential part this information would posture at a later date. So I built up an instrument to separate UK organization XBRL information from the configuration that it had been recorded in.

Presently since I had my first thump back in getting into an industry which I longed for to make my stamp in, I chose to attempt elective approach by pitching information to the fundamental players in the receipt fund space.

Inevitably, I figured out how to utilize the XBRL information I had remove into arrangements of thousands of organizations who were resource rich however money poor, I did this by utilizing the Altman Z-score equation which I look into and found the recipe on the web.

This same recipe is at present utilized by rating offices, for example, Moody's to decide the probability of chapter 11 by a business. Outfitted with my focused on customer rundown of organizations who have income issues I chose to come and pitch my item to different banks and monetary house who represent considerable authority in the receipt back market. In spite of the fact that I discovered achievement in offering the information I discharged how antedated these banks and other monetary foundations were in finding these sorts of customers.

For instance, most firms contract 100s of offers faculty to go out and thump on entryways of organizations in their general vicinity to perceive how that business is getting along and whether they require extra income. I would once in a while envision to what extent and what number of offers staff it would take to discover 100 potential customers when I could simple do this at a tick of a mouse. It was not long subsequent to having those considerations coming all the more frequently that I chose to assemble my own particular receipt fund stage.

Bitcoin, Ethereum and Blockchain what are they? I some way or another missed the primary Fintech wave since I was excessively associated with the information I had been investigating and pitching to different banks and organizations. Late 2015 I had a call from a companion he was endeavoring to disclose to me about bitcoin and how he profited by purchasing and offering it.

I quickly kept in touch with him off as an informal investor and I didn't at first discover any enthusiasm for what he was stating as I had frequently day exchanged the past and felt exchanging was not for me in the event that I needed to keep whatever is left of my hair. It was not until fourteen days after the fact when a similar companion welcomed me out for beverages and chose to pay for the beverages the entire night.

I inquired as to why he demanded paying for everything and he answered that he had made a not too bad benefit from a major bitcoin exchange, right then and there I investigated his eyes and saw something other than what's expected about him than I had seen some time recently.

The following morning I was up on my portable PC exploring bitcoin and what the innovation could do when I ran over keen contracts, wow what is this I pondered internally. A PC contract however how, I read to an ever increasing extent and couldn't get my head around it or the code that is especially a branch of JavaScript.

So I choose to go to a get together in London, I went to one called Coinscrum which was my initially get together and left far from the get together the first run through feeling energized a little with new companions I made that night who likewise appeared significantly more energized than I was.

I at long last began to comprehend what the entire bitcoin thing was about and another blockchain called Ethereum. I continued attempting to combine my comprehension of SQL and NoSQL with the blockchain and understood that I needed to release the past keeping in mind the end goal to push ahead. A couple of months past, I at long last felt prepared and knew precisely what I needed to fabricate this time round and on a scale not endeavored yet. So I began to assemble a constant money related commercial center utilizing XBRL information on the blockchain, Populous.

So what is Populous? All things considered, the term Populous alludes to the general population of a group, state or nation. I picked the name Populous after I went gaga for the clique amusement that bears a similar name that was made by Peter Molyneux. Pupulous is in as much as the amusement, is where we the general population of the group meet up overall to give fund to organizations who require an infusion of money.

This is finished by two subsidizing hones referred to in the money related world as receipt and exchange fund. Pupulous is not at all like some other receipt back commercial center, as the stage is based over the Ethereum blockchain and furnishes speculators and venders with a method for exchanging solicitations in a half breed sell off/swarm financing model done by savvy contracts.

I considered how this the stage would function on the off chance that I needed to utilize just bitcoin or ether and due to the unpredictable idea of both cryptographic forms of money I chose to make our own 'Pokens'. This now enables the stage members to exchange a more steady condition and over all monetary forms and countries.

Today I will talk more on receipt fund and in my next post jump further into exchange back and why such a great amount of cash as been filled blockchain extends by banks and monetary establishments that are attempting to think of a blockchain arrangement these regions of fund.

- Overview - Table of Contents

- What Is Populous?

- Getting Started With Populous

- How To Get A Populous Wallet?

- Populous Resources

- How To Buy Populous?

- How To Earn Populous?

- What Is Populous Mining?

- Latest Populous News

I expect we as a whole know what a receipt is? For those perusing this article from nations that are not acquainted with the term receipt, I will attempt and give an unmistakable clarification of this sort of business instrument. All things considered, other than a receipt it is known as a bill or tab.

It is a business archive expressed by Wikipedia. It is given by a dealer of products or administrations to a purchaser who buys these merchandise or administrations from the vender. The receipt general requests installment of the products or administrations inside a specific time period. The period of time given to pay a receipt is concurred by the two gatherings and can run from 30 days straight up to 90 days and longer now and again.

So what's the issue here? Since business visionaries, little and medium size organizations make a decent attempt toward the begin to influence their organizations to work, they in some cases hop or wind up in these sort of offers plans keeping in mind the end goal to finish offers of their items.

The installment terms may not generally be great to them but rather that is business and they have to pitch their merchandise or administrations to shield the business from going under. This occasionally causes what is known as an income issue if the merchant of the products or administrations needs the cash sooner to pay different things like wages, providers or different sorts of costs of doing business.

Did you realize that the receipt back industry is self-directed? This implies anybody can loan cash to organizations and you needn't bother with a permit. I've regularly pondered in the past why this industry is overwhelmed by banks and monetary organizations and not by the general population.

The basic answer is capital. In any case, that is going to change with the entry of Populous. I'm meaning to brake down the boundaries to section, giving everybody the chance to contribute from as meager as $100 and acquire premium financial specialists could just dream of.

The opposite side of the coin is that we will utilize XBRL information to open the market up to organizations over the globe making it simple for them to get the income back expected to develop their organizations effectively. A monetary upheaval is coming, don't miss the opportunity to be a piece of it. Put resources into Populous ICO.

What Is Populous Mining?

Populous is an invoice and trade finance platform built using the latest in blockchain technology. Populous uses XBRL, Smart Contracts, Stable tokens and more to create a unique trading environment for investors and invoice sellers from all around the world.

Populous have a plan to make a new and next generation financial marketplace. Populous is a first and only invoice & trade finance platform on the Ethereum blockchain and work for buying and selling invocices globally.

The flow of funds within the platform is realized by the usage of custom stable currency tokens (Pokens) pegged 1 to 1 with worldwide government’s currencies. Pokens are backed by the funds of investors who deposit funds on the platform to finance invoices.

Once invoices are financed by investors, pokens are sent to invoice sellers also known as the borrowers. Pokens can either be exchanged for fiat currency or transferred to an external Ethereum wallet.

Pokens works on two fronts, “Pokens inside the platform and Pokens outside the platform”. Poken inside the platform; The platform manages an internal ledger with the balances of each borrower’s and investor’s accounts for each currency.

Pokens outside the platform; Outside the platform, Populous provide a publicly accessible smart contract for each token, implementing the Ethereum ERC 20 token standard (external token contract).

Populous is an online platform that matchmakes invoice sellers to invoice buyers hosted on the blockchain. This enables the invoice buyers to receive interest on their invoice purchase while invoice sellers receive short-term cash flow. The company’s unique selling proposition lies in its ability to provide value to both invoice sellers and buyers with interest rate bidding and XBRL targeted client acquisition respectively.

The company adopts a multi-sided business model where both invoice buyers and sellers contribute to the Populous. While the initial driver of growth is the targeted client acquisition program, organic growth will follow with aggressive marketing and branding campaigns.

The Populous platform is designed to scale, with an estimated 43,000 clients in Year 1 to 297,000 clients in Year 3 as per Figure 8 with an annual turnover of £19.6 million and profit of £5.6 million. With the built-in client targeting mechanism, Populous is expected to break-even in the third quarter of Year 1.

This business plan performed a sensitivity analysis on the conversion rate of the XBRL targeted clients of 3%, 6% and 10% as the Worst Case, Base Case and Best Case scenario. The conversion rate is chosen to perform the sensitivity analysis to give the best range of results as this directly impacts both the Profit and Loss Statement and the Balance Sheet.

The Worst Case scenario projected a £2.8m net profit in Year, while the Best Case scenario observes the platform netting a £14m profit for the same year. All three scenarios put Populous in a net cash position, meaning the company does not require loans to utilize as working capital.

Populous is also seeking to record a gross profit margin of 80%, an EBIT margin of 36%, and a net profit margin of 29% in 2020.

During the first three years, the focus will be on building a solid fundamental for sustainable growth. As well as developing the platform, Populous will invest in recruiting and training employees that not only are qualified but also fit within the organization.

Capabilities need to be fine-tuned to extract the maximum potential, additional required competencies and capabilities will then be identified for additional hiring. A safe and secure platform will also be a main area of focus, vital in building both customer and investor confidence.

In this phase, Populous will be aggressively securing SMEs in the UK to participate in the platform. Customer acquisition will remain a priority throughout this high growth phase, with us forecasting targeted and organic customer growth in the high double-digits YOY.

To achieve that, Populous will also be heavily investing in branding and marketing. Branding – from the company tagline, brand colors to logo design – is the foundation and one of the most important aspects of the business as it influences the way customers, employees and competition perceive the company, and there is only one chance to make a brand impression. Majority of revenue will be allocated to marketing to acquire and retain customers to grow the business and cashflow in the longer term.

Populous will form corporate partnerships to receive a steady inflow of invoices on the platform. The increased invoices will attract more buyers, where it will lead to more invoice sellers, creating a loop of network effect. In the short term, Populous seeks to form corporate partnership aggressively to ensure consistent inflow of invoices in the platform.

Core components of the platform include:

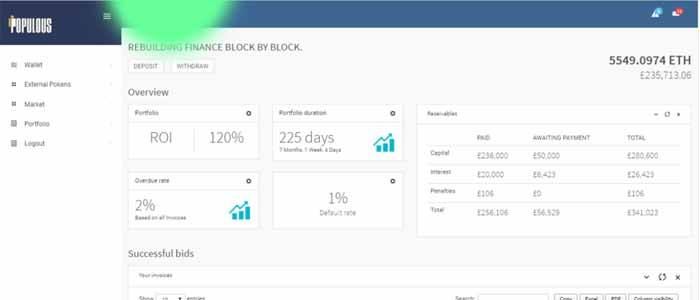

Easy and intuitive UI

Populous has made the interface smooth and intuitive for investors and invoice sellers alike. Investors can track all the invoices that they bid on, the average interest rate received, amount of Pokens available and loan due dates.

Invoice sellers can track the state of the invoices to determine if the invoices are bid on and the winning interest rate. There is also an option to sell more invoices on the platform, which is seamlessly integrated into the platform to enable a quick transaction to take place.

Traceable data from within the platform</h4.

Invoices that has received funding will be traceable on the platform via the blockchain. The invoices can be traced via etherscan, a blockchain explorer that does not require moving out of the platform. Instead, a pop out window allows easy and transparent tracking of the invoice.

Interactive component

The platform includes a “game-like” component where investors can compete in bidding for invoices to invest in. The winner will be the lowest proposed interest rate. The bids will be open for 24 hours, where the winner will then proceed with the winning interest rate bid.

Populous Resources

How To Buy Populous?

The base currency for the Poken is a given national fiat currency based on the needs and location of the transaction. Pokens are initially tied to the British Pound (GBP).

Participants can convert their GBP Pokens to Pokens of other currency denomination within the platform. For example, the participant can convert their GBP Pokens for USD Pokens based on prevailing conversion rate set by the London Stock Exchange. All currencies will be set by the national stock exchange of the territory.

- Overview - Table of Contents

- What Is Populous?

- Getting Started With Populous

- How To Get A Populous Wallet?

- Populous Resources

- How To Buy Populous?

- How To Earn Populous?

- What Is Populous Mining?

- Latest Populous News

Fund deposits can be made in Bitcoin which are exchanged for Pokens according to an aggregated BTC/USD pair exchange rate at time of deposit. On withdraw, Pokens can be exchanged for any supported government's currency or well-established cryptocurrencies such as Bitcoin or Ethereum.

XBRL (eXtensible Business Reporting Language) is a global standard for exchanging business information and is freely available to anyone. It is developed and published by XBRL International, Inc. We use XBRL to define and exchange financial information.

Companies submit financial statements to government regulators each year. XBRL uses these statements and internationally standardises these data so they can be reviewed and compared regardless of geographic origin.

We have built a XBRL back-end as part of our in-house credit reference system and targeted marketing database. With this XBRL engine we extract useful data that gives us the ability to foresee multi-industry trends in real-time. This data comes from more than 2 million sets of financial statement we collect each year as they are filed with the UK Companies House.

We currently collect approximately 1 petabyte of data (or nearly 20 million, 4 drawer filing cabinets filled with text documents) every 6 to 12 months. Our automated analytical tools develop useful insights from this exceptionally large amount of data. These financial data insights flag opportunity/risk which are directly used on the Populous platform to reduce the costs of short term funding for invoices.

The Z-score formula published in 1968 by Edward I. Altman is a standard formula used globally in the financial industry. The formula provides three predictive measures: i) the probability that a business will go into bankruptcy within two years, ii) whether or not a business will default, iii) a control measure for financial distress.

With the combination of extracted XBRL data and the Altman Z-Score formula we have not only bypassed the need to use an external credit reference agency, but have also gained a technological and financial edge over our competitors.

By combining these data sets, we are able to more effectively target companies in need of cash flow. The same data sets can be used for many other business use cases, but we are currently focusing on the invoice finance industry and will seize a significant portion of market share from our main competitors.

XBRL targeted acquisition

The Populous platform is built-in with a targeted client acquisition system which includes scanning the XBRL database for potential clients who may require short term liquidity. As the XBRL database is updated real-time with financial data, the database of potential invoice sellers for Populous is also always up-to-date. For a more detailed information of the XBRL targeted client acquisition, please refer to the white paper.

Bidding for lowest interest rates

Invoice sellers are incentivized to utilize the Populous platform as Populous implements a invoice bidding mechanism. Invoice buyers will bid to purchase the invoice at their lowest acceptable interest rate, and the bidding process will result in the invoice sellers receiving the best interest rates. The bidding process will only take 24 hours before the funds will be released to the invoice seller, which is similar to the industry practice.

Cost

As a benefit of being hosted on a blockchain is that the transaction costs are reduced. With lower transaction costs, Populous can transfer the savings to invoice sellers and buyers.

Efficiency

The Populous platform is hosted on the blockchain where it utilizes smart contracts to perform automated tasks including running the company's credit rating over Altman's Z score to determine the interest rate of the invoice that is sold. This provides users with a seamless transaction where there is little idle time in the transaction. The throughput of an invoice successfully bought will be a little over 24 hours for the bidding process to take place, above industry practice.

Auditable trail

The platform allows for users to view the invoices that are already purchased on the blockchain, providing easy scrutiny to the trail of transactions that took place. This shows a verifiable trail of transaction, allowing for an easy audit of actual events that occurred.

Accuracy

As blockchain transactions are largely immutable, invoices that have been financed and recorded into a block cannot be financed again. This will avoid duplicate invoice to be financed by other players in this industry and no invoices are financed twice on the platform.

Accessibility and anonymity

Invoice buyers can partake in the purchase of invoices online, hence they are not geographically restricted. Participants globally can log into the platform and start purchasing invoices. With Populous, there is a low barrier to participate as the platform is accessed online.

How To Earn Populous?

Populous just issued an announcement via their Medium blog giving a “Populous Update”. The announcement was jammed packed with juicy updates and the minds boggles with the thought of what is next to come!

The Populous Update references the latest version of the website. The website is the first point of contact which new and prospective customers and first impressions will make or break a deal. If you attend a job interview all disorgainsed, what impression would you broadcast about yourself to your prospective employer. I would say nothing good.

The website is dynamic and the graphics yummy. The website exudes confidence and is refreshing compared to the many “formal” websites you find out there. The website uses a colour scheme that is welcoming and tells me that my money is safe when buying invoices on the platform.

The website is informative and explains invoice financing the “Populous Way” in an easy to understand format. It draws you in, especially those new to the invoice financing market and those new to the crypto-space. There is even an element of fun that gives the website a little human touch.

When you click the Populous link you will be greeted with the Populous homepage. This is the start of your journey to invoice financing the Populous Way.

Invoice finance is a way of funding businesses that need liquidity. Businesses can sell invoices to allow early access to funds which would otherwise be tied up for a significant period of time. The deferred payment period can be anywhere between 30 days and even as long as 90 days or more.

For example, if an invoice has a value of $10,000 with a payment period of 60 days, the business will not likely be paid by its customer until the 60 day period is up. In the meanwhile, the business un-expectedly encounters liquidity issues and they approach Populous for immediate short term finance. Populous can provide funds which the business can use very quickly without waiting for his customers to settle.

The invoice seller sells his invoice for (say) $9,000 on the Populous invoice marketplace for instant liquidity. On invoice due date he will paid back into the platform the full face value of $10,000 in which $1,000 is the interest paid to the invoice buyers of which a small percentage will be deducted to cover Populous' fee.

The Populous Way brings sellers and buyers together from all over the world to solve a very simple problem very quickly, fairly and honestly. All parties are happy: the invoice seller has met his immediate liquidity needs, the invoice buyers have profited from buying the invoice and Populous as the facilitator has made profit from transactions fees.

Many Small and Medium Size Enterprises (SME) very often find themselves with liquidity issues. In many cases the SMEs needing to access liquidity quickly will be taken advantage of by the available lending institutions by charging exorbitant fees.

Populous is built around a marketplace that brings together invoice sellers and invoice buyers. As a marketplace it gives the invoice sellers more competitive rates as oppose to existing banks and other lending institutions.

This is where blockchain technology gives Populous the advantage because of lower cost, speed of transaction and protection against fraud.

The invoice seller simply puts up the invoice he wants to sell, wait for the bidding process to close and receive the required funds. Since invoice buyers are looking for yield they will place competitive bids to win invoices.

This is good for the invoice sellers because they will get a better price than from the traditional invoice finance providers.

Where there are invoice sellers there must also be a group of invoice buyers. All buyers are only interested in one thing and one thing only – the pursuit of yield. Buyers have funds sitting idle and want to put this capital to work. There is no place better than Populous.

Buyers can buy invoices on Populous and “Get Fantastic Returns With Minimal Risk” – too good to be true? As with all investments, they can moon or go to zero, so only put in the amount which you can afford to lose (Not Financial Advice!).

However, when buying invoices on Populous there will be trade insurance, director’s guarantees, and liens in place to miminise risks. These requirement on invoice sellers gives added protection to invoice buyers and especially Populous.

What does this mean?

Trade Insurances - When a sellers puts up invoices for sale on Populous he is required to buy trade insurance with Populous as the beneficiary. This allows Populous to follow up in cases of late payment and defaults.

- Overview - Table of Contents

- What Is Populous?

- Getting Started With Populous

- How To Get A Populous Wallet?

- Populous Resources

- How To Buy Populous?

- How To Earn Populous?

- What Is Populous Mining?

- Latest Populous News

Director’s Guarantees – Do not belittle this undertaking. This is a very serious stuff, when giving a “Director’s Guarantee”, it means that the director who has given the undertaking is no longer protected by the company he works and is personally liable for the loan. This is quite an incentive to make sure that the loan is repaid.

Liens - A lien is a form of security made against the loan. Usually liens are taken out on properties to secure against the loan. If the invoice seller defaults there is an option to go after things that are tangible.

Populous also allows pooling of funds between invoice buyers when buying invoices especially invoices with large face value. If you do not have sufficient funds to buy a particular invoice you can join with other buyers to bid for an invoice.

Pooling also allows you to lower your risks in cases of defaults and rather than going all-in on a particular invoice, spread your funds amongst the many invoices to reduce exposure to possibility of defaults.

What About PPT Holders?

The site does not focus much on the use of the PPT token to buy invoices. The platform is for SMEs and connects businesses with buyers who can provide liquidity. Introducing customers to the PPT token and hence the larger cryptocurrency market in general will only confuse and scare sellers away.

There is no discrimination on the platform between PPT holders and buyers using fiat. Both PPT holders and buyers using fiat have access to the same invoices, receive the same interest and pay the same fees. However there maybe an alert system in place that alerts PPT holders when a new invoice is uploaded to the platform giving "priority" to PPT holders.

Apart from the alert system, why would Populous marginalise a large segment of the market, it would not make sense.

The crypto community is still relatively small and what you don’t know or understand is a warning sign flashing “danger”. The Mt. Gox debacle is probably still fresh in many minds and the mention of crypto will probably scare away many customers and is obviously not what Populous want.

However as PPT holders and to those in this crypto-space, we all know the benefits that PPT holders gain from using the PPTs on the platform. As long as you are aware of this, PPT will retain its value.

What Is Populous Mining?

Populous Swimming in Dough

Populous is like your bank account and the liquidity pool the amount of funds you have at your disposal. When your bank account is filled with fiat you will have “money” to spend. You can go out to buy things and make investments to grow the amount of fiat you have.

Populous Counting Beans

The business plan tells you a lot about the steps a company intend to take to grow the business. Read the plan careful and you can glean tidbits from the plan as to what they intend to do. Populous is no different and their UK business plan was a very good read indeed.