What Is Stellar Lumens?

Stellar's innovation fills in as the center spine of this cross-outskirt installments arrangement. The Stellar system empowers frictionless, adaptable, and for all intents and purposes free cross-fringe installment exchanges, and has been turned out to be ready to safely process more than 1,000 exchanges for each second with a billion special client accounts.

- Overview - Table of Contents

- What Is Stellar Lumens?

- Getting Started With Stellar Lumens

- How To Get A Stellar Lumens Wallet?

- Stellar Lumens Resources

- How To Buy Stellar Lumens?

- How To Earn Stellar Lumens?

- Where To Spend Stellar Lumens?

- What Is Stellar Lumens Mining?

- Latest Stellar Lumens News

Having experienced childhood in Oceania, Robert Bell, organizer of KlickEx Group, has direct involvement with the dissatisfactions and wasteful aspects of sending installments through immature installment passages.

He make KlickEx to meet basic settlement and outside trade needs in the district. Presently, he sees guarantee in Stellar's blockchain innovation to change the settlement business by significantly enhancing the cost and speed of exchange clearing, settlement, and consistence.

This cross-outskirt installments arrangement is as of now preparing live exchanges in 12 cash halls over the Pacific Islands and Australia, New Zealand and the United Kingdom.

IBM has assembled an underlying gathering of various saving money pioneers as a component of the improvement and organization process, including Banco Bilbao Vizcaya Argentaria, Bank Danamon Indonesia, Bank Mandiri, Bank Negara Indonesia, Bank Permata, Bank Rakyat Indonesia, Kasikornbank Thailand, Mizuho Financial Group, National Australia Bank, Rizal Commercial Banking Corp. (RCBC) Philippines, Sumitomo Mitsui Financial Group, TD Bank, Wizdraw (HK) of WorldCom Finance, and other monetary organizations.

"This new development and joint effort speaks to a critical point of reference for Stellar and in addition the money related innovation industry overall," said Jed McCaleb, fellow benefactor of Stellar. "Out of the blue, open blockchain innovation is being utilized as a part of creation to encourage cross-fringe installments in numerous coordinated money hallways. Presently, cross-outskirt installments take up to a few days to clear.

This new execution is ready to influence a significant change in the South Pacific area, and once completely scaled by IBM and its managing an account accomplices, could possibly change the way cash is moved far and wide, enhancing existing universal exchanges and progressing monetary consideration in creating countries."

Stellar is eager to team up with IBM and KlickEx on the advancement and worldwide usage of this progressive cross-fringe installments arrangement.

MAJOR STELLAR CONCEPTS

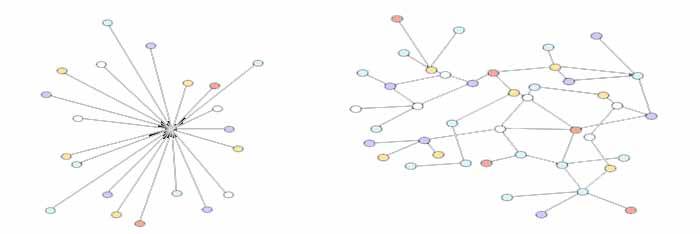

Decentralized network

A decentralized system comprises of associates that can run autonomously of each other. The ability to transmit data is dispersed among a system of servers, rather than being driven from one essential source.

This implies the Stellar system does not rely upon any single substance. The thought is to have whatever number autonomous servers take an interest in the Stellar system as would be prudent, with the goal that the system will in any case run effectively regardless of the possibility that a few servers fall flat.

Ledger

Like a traditional ledger, the Stellar ledger records a list of all the balances and transactions belonging to every single account on the network. A complete copy of the global Stellar ledger is hosted on each server that runs the Stellar software. Any entity can run a Stellar server.

These servers form a decentralized Stellar network, allowing the ledger to be distributed as widely as possible. The servers sync and validate the ledger by a mechanism known as consensus.

Consensus

The Stellar servers communicate and sync with each other to ensure that transactions are valid and get applied successfully to the global ledger.

For example, if you want to send $5 to a friend on the network, a list of trusted servers will begin a process to agree on the validity of your $5 payment to your friend. The majority of these servers will have to agree that you do in fact own $5 worth of credit on the network before they will mark the transaction as valid.

This entire process of coming to consensus on the Stellar network occurs approximately every 2-5 seconds.

Prof. David Mazières describes the technical process of consensus in his white paper, The Stellar Consensus Protocol (SCP). You can also explore other resources explaining SCP.

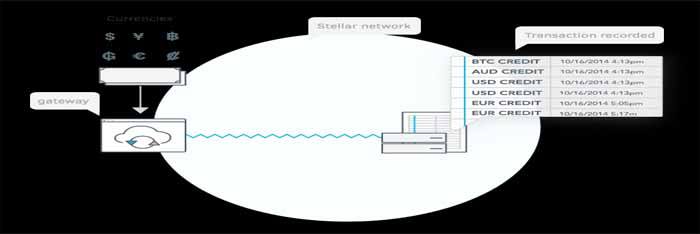

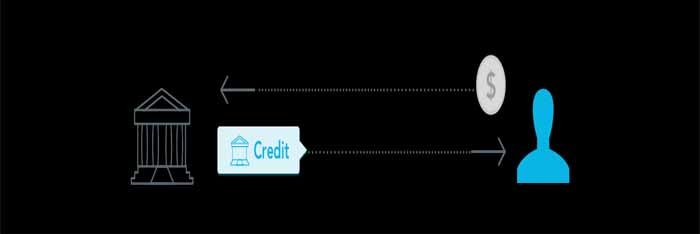

Anchors, Trust, and Credit

Anchors are simply entities that people trust to hold their deposits and issue credits into the Stellar network for those deposits. They act as a bridge between different currencies and the Stellar network. All money transactions in the Stellar network (except the native digital currency of lumens) occur in the form of credit issued by anchors.

Anchors do two simple things:

1. They take your deposit and issue the corresponding credit to your account address on the Stellar ledger.

2. You can make a withdrawal by bringing them credit they issued.

You have to trust the anchor to honor your deposits and withdrawals of credit it has issued.

Anchors exist in the pre-stellar world now. For example, to use Paypal, you deposit money in from your bank account. Paypal then gives you credit in your Paypal account.

You can now send that Paypal credit to anyone that trusts Paypal (anyone with a Paypal account). Someone that received your Paypal credit can convert it to real money using Paypal by withdrawing it to the bank.

- Overview - Table of Contents

- What Is Stellar Lumens?

- Getting Started With Stellar Lumens

- How To Get A Stellar Lumens Wallet?

- Stellar Lumens Resources

- How To Buy Stellar Lumens?

- How To Earn Stellar Lumens?

- Where To Spend Stellar Lumens?

- What Is Stellar Lumens Mining?

- Latest Stellar Lumens News

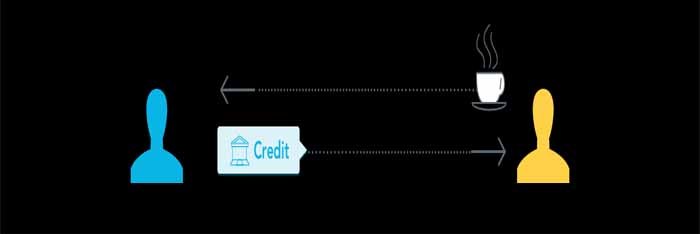

Anchors perform the same function in Stellar. The difference is, all the “Paypals” and other anchors are operating on the same network so they can all transact with each other now – this makes the system way more powerful. People can now easily send and exchange all these different anchor credits with each other.

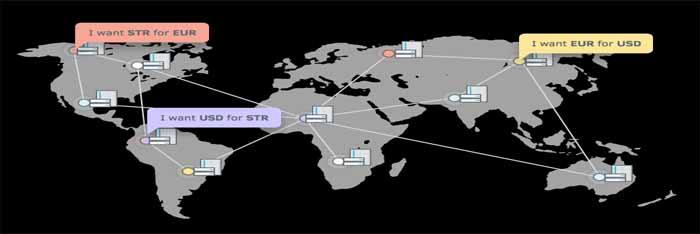

Distributed Exchange

The Stellar ledger is able to store offers that people have made to buy or sell currencies. Offers are public commitments to exchange one type of credit for another at a pre-determined rate. The ledger becomes a global marketplace for offers.

All these offers form what is called an orderbook. There is an orderbook for each currency/issuer pair. So if you are wanting to exchange Virgin Bank/EUR for bitstamp/BTC you look at that particular order book in the ledger to see what people are buying and selling it for.

This allows people to not only buy and sell currencies in a foreign exchange like manner but also to convert currencies seamlessly during transactions.

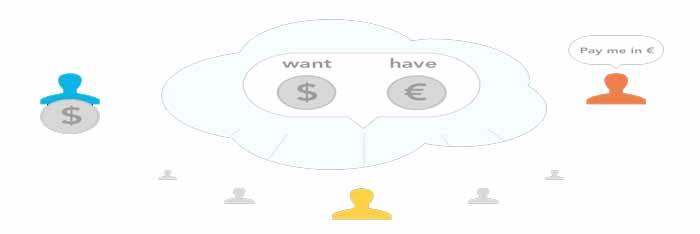

Multi-currency Transactions

Stellar allows you to send any currency you hold to anyone else in a different currency through the built-in distributed exchange. People can receive any currency through an anchor they added.

For example, Amy wants to send Bob euros, using her USD balance. Stellar automatically submits an offer to the distributed exchange selling USD for EUR. The network finds the best exchange rate for the transaction.

Here’s a few possible ways the transaction can happen:

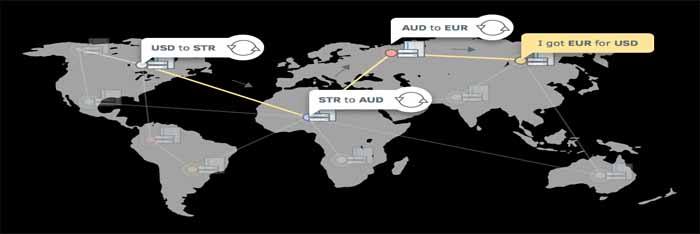

Conversion through an offer

Stellar finds an offer on the internal USD/EUR exchange for someone wanting to buy EUR for USD and automatically makes the exchange between the two parties.

Using lumens as an intermediary currency

Stellar looks for offers on the network asking for USD in exchange for lumens (the native — purely digital — currency). It simultaneously looks for an offer asking for lumens in exchange for euros. The network makes those exchanges and sends Bob the resulting euro credit.

Chain of conversions

If there are no explicit relationship between offers to buy and sell, Stellar tries to find offers from the network that will lead a chain of conversions from EUR to USD. For example, EUR to AUD, AUD to BTC, BTC to XLM, XLM to USD.

INTEGRATION PROCESS

In general terms, integration means configuring your systems to talk to the Stellar network.

The Stellar integration process is relatively straightforward. First, identify the use case that is most appropriate for your business.

Stellar Network Use Cases

MICROPAYMENTS - Decrease the cost of smaller transfers. Offer incremental payment options to your customers.

REMITTANCES - Send money to different countries quickly, for a fraction of a cent. Facilitate low-cost payments between different currencies.

MOBILE MONEY - Make mobile money platforms interoperable. Let your customers send MM to recipients with different providers.

SOCIAL ENTERPRISES + NGO PROJECTS - Use low-cost financial services to bring about sustainable social change.

Next, your technical team will set up database tables, write code to listen to the Stellar ledger, conduct transactions, and test your integration.

Stellar offers software, tools, and documentation to assist the technical side of the integration process.

START-UP COSTS AND INTEGRATION FEES

The Stellar network is free to use.

All of the software necessary for integration is licensed under the Apache License, version 2.0. This license permits commercial use, modification, and/or distribution.

Integrators will need to dedicate technical resources to integrating with Stellar. It typically takes between 120-200 hours of technical development, depending on the size and experience level of your developer team.

COMMERCIAL RESTRICTIONS

There are no restrictions on any commercial use of the Stellar network.

Please see Start-Up Costs and Integration Fees above for information on our open software license.

STELLAR.ORG’S BUSINESS MODEL

Stellar.org operates as a non-stock nonprofit organization. Our mission is to connect people to low-cost financial services to fight poverty and maximize individual potential.

To that end, we don’t charge people or institutions for use of the Stellar network.

Stellar.org covers operational costs in several ways:

- 5% of the initial lumens are set aside for operational costs.

- Stellar.org accepts tax-deductible donations from the public.

They received an initial infusion of funding from the payments startup Stripe. Their corporate donors include BlackRock, Google.org, and FastForward.

THE STELLAR NETWORK VERSUS STELLAR.ORG

The Stellar network refers to the technology that processes financial transactions. The technology is open source, distributed, and community owned.

- Overview - Table of Contents

- What Is Stellar Lumens?

- Getting Started With Stellar Lumens

- How To Get A Stellar Lumens Wallet?

- Stellar Lumens Resources

- How To Buy Stellar Lumens?

- How To Earn Stellar Lumens?

- Where To Spend Stellar Lumens?

- What Is Stellar Lumens Mining?

- Latest Stellar Lumens News

Stellar.org is the nonprofit organization that contributes to the development of tools and social good initiatives around the Stellar network and financial inclusion. Employees contribute code to the Stellar network, but the technology is independent of the organization.

STELLAR NETWORK STRUCTURE

Horizon API

An API is simply a set of tools and building blocks for creating software applications.

Horizon is a RESTful API that allows you to submit transactions to the network, check the status of accounts, and subscribe to event streams.

Stellar Core

The distributed Stellar network is made up of servers running the Stellar Core software. These servers are maintained by different individuals and entities.

Stellar Core maintains a local copy of the network ledger, communicating and staying in sync with other instances of Stellar Core on the network.

SCALABILITY

A transaction on the network consists of one or more operations. Payments, offers, and fees are all examples of operations that could make up a single transaction.

Depending on hardware and network configurations, a conservative estimate of Stellar’s processing rate is 1000 operations per second.

TRANSACTION FEES

There’s a nominal fee, referred to as a base fee, associated with each operation in a transaction.

The base fee functions as a deterrent: Though nominal, it discourages users with malicious intentions from flooding the network with transactions (otherwise known as a DoS attack).

The base fee is currently set to .00001 XLM—a fraction of a fraction of a penny. The sender of the transaction incurs the fee.

No one profits from the base fee. The ledger collects the fees and redistributes them in the process of inflation.

RESOLVING DISPUTED TRANSACTIONS

While transactions are irreversible on the Stellar network, it is possible to freeze the assets you issue.

Freezing an asset renders the asset valueless to the user, ensuring that it can only be sent back to you.

For example, let’s say you accidentally credited the wrong customer account with ₦200. You can simply freeze those naira, preventing the customer from spending any mistakenly sent funds. Freezing an asset is a simple operation that takes effect within 3-5 seconds.

RISK AND THE STELLAR NETWORK

The Stellar network mitigates risk through a decentralized and distributed structure.

If Stellar.org were to disappear, the network would continue to confirm transactions, and anchors could still integrate with the network at any time. All Stellar Core validators are run by community members external to Stellar.org.

Stellar.org runs a pair of non-validating read replicas and archives history to our own Amazon S3 buckets.

COMPLIANCE AND REGULATION

Stellar is software—think of it as the middleware that sits between financial products and institutions. As such, we are not a licensed financial institution.

If your organization plans to accept deposits and issue credits on the Stellar network, it is likely you will need to be a licensed money services provider (MSP) or mobile money operator (MMO).

All integrators should heed the regulatory environment of their organization.

KYC AND AML

Integrators are responsible for implementing all KYC/AML identity verification requirements.

However, Stellar has produced tools to help financial institutions with their integrations. Integrators may find the compliance protocol helpful.

PRIVACY OF TRANSACTIONS

All transactions on the network are public.

With third-party tools like Lightning, private transactions are possible. Consult your technical team on whether such tools would work for your implementation.

SECURITY BEST PRACTICES

Our recommended design is to use at least two Stellar accounts: a base account and an issuing account.

Issuing accounts can serve as the intermediary pool between the base account and customer’s accounts.

A base account’s credentials should be kept on a computer that is not connected to the Internet and cannot be compromised.

Ensure that all of your assets are marked AUTHORIZATION REVOCABLE so you can freeze them in an erroneous situation.

Advise technical teams to follow the configuration recommendations outlined in the developer documentation.

LOW-BANDWIDTH ENVIRONMENTS

Though transactions require an Internet connection at the moment, tools for low-bandwidth environments are in development.

Getting Started With Stellar Lumens

Stellar Network vs Bitcoin

The main differences between the Stellar network and Bitcoin are the following:

- Stellar is based on a consensus algorithm rather than mining. This means transactions confirm in a few seconds.

- The supply of lumen increases at a fixed rate of 1% a year.

- Stellar aims to let you transact in your currency of choice (fiat or digital).

The hope is that the currency itself will be mostly a behind-the-scenes currency, and that the Stellar network will help provide more liquidity between currencies.

Stellar Transaction Fees

To prevent spam, each transaction burns 100 stroops (that is, 0.00001 lumens). This can result in what looks like an uneven balance in your Stellar account. The $USD value of 10 stroops as of January 2015 is approximately one two-hundred-thousandths of a penny.

Minimum Balance

Minimum balances help protect the network from the creation of spam accounts. You can fund an account by sending 20 lumens to it. Unfunded accounts cannot establish trust lines; each trust line requires a 5 lumen reserve in addition to the 20 lumen minimum balance.

- Overview - Table of Contents

- What Is Stellar Lumens?

- Getting Started With Stellar Lumens

- How To Get A Stellar Lumens Wallet?

- Stellar Lumens Resources

- How To Buy Stellar Lumens?

- How To Earn Stellar Lumens?

- Where To Spend Stellar Lumens?

- What Is Stellar Lumens Mining?

- Latest Stellar Lumens News

To establish trust lines with three anchors, a user must retain a 35 lumen balance in reserve, for example: min balance 20 lumens + (5 lumens * 3 anchors) = 35 lumen reserve.

Protected From Phishing

Read the articles on their Help Desk about phishing and account security. If you think you are being “phished,” please report the attempt to:

- Your email provider

- The appropriate social media platform

- Google’s Safe Browsing Project

You may also report phishing sites and emails to the Stellar Development Foundation by emailing phishing(at)stellar(dot)org.

Build On Top Of Stellar Protocol

There are too many possibilities to name, so here are a few things that people are asking for the most:

- More anchors in more currencies

- Mobile and trading clients

- Tipbot

- Merchant plugin

What Are Lumens?

Lumens are the native asset of the Stellar network.

Native means that lumens are built into the network. Asset is how the network refers to an item of value that is stored on the ledger.

One lumen is a unit of digital currency, like a bitcoin.

While you can’t hold a lumen in your hand, they are essential to the Stellar network—they contribute to the ability to move money around the world and to conduct transactions between different currencies quickly and securely.

In 2014 the Stellar network launched with 100 billion stellars, the original name of the network’s native asset.

In 2015, with the launch of the upgraded network, the name of the native asset changed from stellar to lumen to distinguish it from 1) the Stellar network itself and 2) Stellar.org, the nonprofit organization that contributes to development of the network.

The Stellar network offers all of the innovative features of a shared public ledger on a distributed database—often referred to as blockchain technology. The Stellar network’s built-in currency, the lumen, serves two purposes:

First, lumens play a small anti-spam role.

Each transaction has a minor fee—0.00001 lumens—associated with it. This fee prevents users with malicious intentions from flooding the network (otherwise known as a DoS attack). Lumens work as a security token, mitigating DoS attacks that attempt to generate large numbers of transactions or consume large amounts of space in the ledger.

Similarly, the Stellar network requires all accounts to hold a minimum balance of 20 lumens. This requirement ensures that accounts are authentic, which helps the network maintain a seamless flow of transactions.

Second, lumens may facilitate multi-currency transactions.

Lumens sometimes facilitate trades between pairs of currencies between which there is not a large direct market, acting as a bridge. This function is possible when there is a liquid market between the lumen and each currency involved.

XLM is shorthand for lumen. Most currencies have 3-letter codes (USD, EUR, AUD, BTC) as an international standard.

The technical term for these shorthand codes is ISO 4217.

How To Get A Stellar Lumens Wallet?

Below you'll find a set of different wallets with varying functionality.

Stellar Desktop Client

The Stellar Desktop Client is an open source desktop client. It allows you to encrypt your secret key and store it as a file locally on your computer. Easily trust, send, and trade all within the client.

Key Features

- Login information stored locally

- Send and receive lumens

- Add trust from known anchors

- Create your own asset

- Deposit/withdraw CNY

- Buy/sell lumens

Supports: Windows, Mac, Linux

Lobstr

Lobstr is a wallet for Stellar. Lobstr is available as a web app and also has native Android and iOS apps. Lobstr is a smart and secure way to send and receive Lumens. It’s clean design and helpful features like email notifications simplify the whole experience and make Lobstr one of the most user friendly wallets.

Key Features

- Send and receive lumens

- Quick XLM price converter

- Anti-fraud measures

- Support for operations with multiple transactions

Supports: Windows, Mac, Android, iOS

Stargazer

Stargazer is a wallet application for mobile (i.e. Android) and desktop. Allows for multiple accounts, multiple assets, multiple networks, and multiple languages. The vision is to push the limit; to raise the bar for what a wallet is, and what you can do with it — without adding too much fluff.

Key Features

- Multiple Accounts

- Multiple Assets

- Federated Addresses

- Create/receive multi-sig/multi-party

- Signing requests

Supports: Android, Windows, Mac, Linux

SIKA

A fast, secure and mobile payment system for Ghana.

Key Features

- Connect mobile number/email to bank account

- Send and receive payments

- Cross platform

- Multi-currency (cedis, dollars, pounds, euro)

Supports: Windows, Mac, Android, iOS

Ecliptic

Ecliptic is a Stellar Wallet and Trading Client. It has the ability to add multiple wallets, including hosted, client-side and read-only accounts.

Key Features

- Store lumens, multiple currencies and other assets

- Send payments and fund new accounts

- Connect to your favourite Stellar anchors

- Add contacts to simplify account ID management

- Send and receive at next to no cost (only Stellar platform fees apply)

Supports: Windows, Mac

Saza

Saza is a stellar wallet that helps users manage lumens and other assets.

Key Features

- Manage multiple Stellar accounts

- Send payments in different assets

- Create/Manage Trustlines

- Create/Manage Offers

- View all operations on account

- Set all account options.

Supports: Windows, Mac

Centaurus

Centaurus was the first stellar wallet available on Google Play. It is completely open source! On first startup the app creates a stellar address for you and you can immediately receive Lumens on this address.

- Overview - Table of Contents

- What Is Stellar Lumens?

- Getting Started With Stellar Lumens

- How To Get A Stellar Lumens Wallet?

- Stellar Lumens Resources

- How To Buy Stellar Lumens?

- How To Earn Stellar Lumens?

- Where To Spend Stellar Lumens?

- What Is Stellar Lumens Mining?

- Latest Stellar Lumens News

As soon as you have some Lumens you can start spending them, e.g. by scanning a friend’s QR code. Furthermore you can enter the keys of an existing stellar account to access it with your mobile device.

Key Features

- Display account balances

- Send by manually pasting an address

- Send by scanning a QR-code

- QR-code for receiving

- Simple Stellar Anchor support

- Cross-currency payments

- Encrypted backups

Supports: Android, iOS

Stellar Portal

Stellar Portal is a web application to view and manage stellar accounts. It relies completely on Horizon and has no backend. You can view balances, offers, order books and payment, and do most of operations.

Key Features

- Balances view and edit trustlines

- Send payments

- Issue assets

- Create/Merge accounts

- Account offers view and edit

- List of payments

- Watch orderbooks

Supports: Windows, Mac

StellarTerm

StellarTerm is a web based trading client. With full ability to interact with the Stellar distributed exchange. It aims to make it easy and safe for users of any skill level to trade on the Stellar network. One big feature is that it has a up-to-date list of all the anchors so that users will have a simpler and safer experience.

Key Features

- Exchange currencies

- Create trust lines

- View balance

- See popular exchange markets

Supports: Windows, Mac, Linux

BlackWallet

BlackWallet is an easy-to-use multiplatform web Stellar Lumens wallet. It was built using javascript & Stellar Horizon. It is an enhanced account viewer as it doesn’t require users to create an account – all you need is a private key. Easily perform simple operations all within the wallet.

Key Features

- No registration

- Sending and receiving Lumens, Assets, Tokens

- Assets/Tokens support

- Real time balances (+USD balance)

- Address inspector

- Set inflation destination

- XLM/BTC/XRP data & charts

Supports: Windows, Mac

Luuun

Luuun is local lumens made easy. Built on Rehive, a platform for launching and managing payment applications, Luuun is a web and mobile wallet that supports federation.

Key Features

- Connect mobile number/email to account

- Buy/Sell lumens for cash from a local teller

- Cross platform

- Multi-currency/assets

Supports: Windows, Mac, Android, iOS

Papaya

Papaya is an easy-to-use wallet for Lumens and other assets, such as BTC, LTC, EURT, etc. No technical knowledge required to use it, no keys, trustlines, or minimum balances. Works on every platform where Telegram client exists.

Key Features

- Supports federation

- Path (cross-currency) payments

- Built-in marketplace for peer-to-peer trading.

Supports: Windows, Linux, Mac, Android, iOS, FirefoxOS, Windows Mobile

Stellar Lumens Resources

- Stellar Lumens Official Website

- Stellar Lumens Facebook

- Stellar Lumens Twitter

- Stellar Lumens Github

- Stellar Lumens LinkedIn

- Stellar Lumens Reddit

- Stellar Lumens Slack

Stellar Tools

Interactive way to learn the Stellar API. The source is available here.

Compliance protocol testing app

Interactive tool to test compliance protocol deployment.

Check your balance and send simple payments. This basic client is built on top of Interstellar and connects to the live Stellar network. The source is available here.

Current status of the live and test networks. The source is available here.

This is a demo of Stellar SMS Client. It was originally developed during Stellar Hack Day.

Horizon Reference Overview

Horizon is the client-facing API server for the Stellar ecosystem. It acts as the interface between Stellar Core and applications that want to access the Stellar network.

Horizon allows you to submit transactions to the network, check the status of accounts, and subscribe to event streams. For more details, see an overview of the Stellar network.

- Overview - Table of Contents

- What Is Stellar Lumens?

- Getting Started With Stellar Lumens

- How To Get A Stellar Lumens Wallet?

- Stellar Lumens Resources

- How To Buy Stellar Lumens?

- How To Earn Stellar Lumens?

- Where To Spend Stellar Lumens?

- What Is Stellar Lumens Mining?

- Latest Stellar Lumens News

You can interact directly with Horizon via cURL or a web browser. Stellar.org also provides a JavaScript SDK for clients to use to interact with Horizon.

Stellar.org runs an instance of Horizon that is connected to the testnet.

Libraries

To interact with Horizon use one of the following libraries:

Libraries maintained by Stellar.org:

Community-maintained libraries (in various states of completion) for interacting with Horizon in other languages:

How To Buy Stellar Lumens?

The Stellar network is free to use. The code is open source, with an Apache license.

If you plan to transact on the live network, you’ll need lumens to cover the base fees for those transactions. By design, transactions on Stellar are very low cost. As of 2016, one lumen will cover 100,000 transactions.

You may choose to purchase lumens as a supporter of the Stellar.org mission.

Lumens are also available for purchase on markets and exchanges (see below).

Get Lumens

Lumens are available for purchase on several known markets and exchanges.

Please be aware of the risk associated with all digital currencies, including complete loss of value.

Digital currencies are very innovative but not insured by regulatory bodies such as the FDIC.

Before purchasing lumens, consult the Consumer Advisory brief by the Consumer Protection Finance Board (CPFB) on the potential risks associated with digital currencies.

There is a nominal fee, referred to as a base fee, associated with each operation in a transaction. The sender of the transaction incurs the fee.

The fee functions as a deterrent: Though nominal, it discourages users with malicious intentions from flooding the network (otherwise known as a DoS attack).

The base fee is currently set to .00001 XLM. The fee will increase if the system suspects an account is submitting transactions with the malicious intent to bring down the network.

No one profits from the base fee. The ledger collects those funds and redistributes them in the process of inflation (see the next question, below).

The Stellar network has a built-in, fixed inflation mechanism. New lumens are added to the network at the rate of 1% each year. The network also collects a base fee for each operation in a transaction. The funds from base fees are added to the inflation pool.

As a balancing measure for the ecosystem, anyone who holds lumens can vote on where the funds in this pool go. Each week, the protocol distributes these lumens to any account that gets over .05% of the votes from other accounts on the network.

The Stellar.org mandate reserves 5% of the original lumens to support the operations of Stellar.org.

Stellar.org covers its own operational costs via its own lumens in the following ways:

Auction: We periodically offer portions of the reserved lumens at auction. We refer to this public process as the lumen auction.

The initial auction launched in March 2015 on Poloniex, Kraken, and Haste. Lumens entered these exchanges at the 30-day trailing average price.

The current auction began December 2015 on the Kraken exchange. We offer lumens in small amounts at the market price on the exchange at time of placement.

As an ethical safeguard, no one formally associated with Stellar.org—e.g., Stellar.org employees, consultants, or board members—will participate in the auction.

Batches. We periodically auction larger batches of the reserved lumens to parties interested in supporting the Stellar.org mission.

If you’re interested in acquiring a larger batch of lumens from the Stellar.org reserve, contact the foundation directly.

How To Earn Stellar Lumens?

95% of the lumens created when the Stellar network began will be given away to the world. 5% remains with Stellar.org for operational costs.

Stellar.org designed the giveaway program to ensure that lumens are given away to diverse groups:

- 50% to individuals who want lumens

- 25% for nonprofits to reach underserved populations

- 20% to bitcoin holders

For more information on this breakdown, see the Stellar.org mandate.

To achieve a more inclusive digital economy. Per our mission, Stellar.org works to connect people to low-cost financial services. Giving away lumens for free is an invitation to communities to design the services they need.

To expand the reach of the network. The availability and active use of lumens on the network will increase the network’s utility by many orders of magnitude.

We have learned quite a bit about how to give away lumens effectively. Our first attempt gave lumens away to individuals—a different amount per user—but resulted in some abuse. In that time we gave away 1,694,618,200 lumens.

They are working on a new prototype for the lumens giveaway, slated to launch soon.

As an integrator or anchor (an integrator that is trusted to accept deposits and honor withdrawals, usually a licensed money services provider), you may need lumens to cover base fees for transactions on the network.

As a supporter or community member, you may wish to support the work of Stellar.org and invest in our future success.

In the future, after we have given away all the lumens—which will happen over the next 10 years—everyone will need to procure lumens from exchanges.

Where To Spend Stellar Lumens?

Stellar is a decentralized protocol for sending and receiving money in any pair of currencies. This means users can, for example, send a transaction from their Yen balance and have it arrive in Euros, Yen, or even bitcoin.

They're expecting to support the usual categories of transactions: payments to a merchant, remittances back home, or rent splits with a roommate.

You can hold a balance with a gateway, which is any network participant you trust to accept a deposit in exchange for credit on the network. Stellar also comes with a built-in digital currency, referred to as the stellar, which They're giving away for free.

- Overview - Table of Contents

- What Is Stellar Lumens?

- Getting Started With Stellar Lumens

- How To Get A Stellar Lumens Wallet?

- Stellar Lumens Resources

- How To Buy Stellar Lumens?

- How To Earn Stellar Lumens?

- Where To Spend Stellar Lumens?

- What Is Stellar Lumens Mining?

- Latest Stellar Lumens News

The currency will have value (as determined by the market); however, its primary function is providing a conversion path between other currencies.

Stellar is built on the concept of gateways—entities that let people get into and out of the network.

You need to trust the gateways you use, but you don’t need to trust the other participants in the network. This is similar to trusting your local bank to hold a deposit on your behalf.

In Stellar, you explicitly decide how much you’d like to trust a gateway by setting policies such as “I trust this gateway to hold a deposit of up to 100 CAD on my behalf”.

Currency balances are represented as credits from the gateway. For example, a user could deposit 100 USD into an appropriate gateway via ACH, and the gateway would issue a “(100, USD, Credits can be traded between users without involving the gateway. Cashing out of the network requires invoking the promise represented by a gateway’s credits. You return those credits to the issuing gateway, and the gateway sends you the corresponding currency. Because the currency return is external to the network, you need to trust the gateway to follow through on their commitment (just as you trust your bank to return your deposit upon request). Since it’s a distributed and open network, anyone is able to start their own gateway, and to take their pick of gateways to trust. Stellar bakes a distributed exchange into the protocol. You can think of the exchange as a single large pool of offers of the form “I’ll trade (100, EUR, Outstanding orders to convert between a gateway’s local currency and stellar let anyone on the network send local currency credits to that gateway’s users. Behind the scenes, there might be a series of conversions along the way. For example, a user might submit a transaction which converts EUR credits to stellar and then converts those stellar to AUD credits. Ultimately, the user will have sent EUR, the recipient will have received AUD, and two exchange orders will have been fulfilled. Under the hood, Stellar uses its own distributed ledger, which is maintained by a consensus algorithm rather than mining. Each node in the network communicates with a set of other nodes that it believes will not collude (such as nodes run by universities, governments, and companies). Importantly, it doesn’t need to trust the nodes themselves — it just needs to believe the nodes won’t work together to produce the same malicious result. Consensus is then reached by an iterative process, which results in each new ledger being decided upon every few seconds. Correspondingly, transactions confirm nearly instantly, and no mining is needed. The Stellar network is just getting started. Today, you can test it out by sending and receiving stellar (or you can use the API to play with running your own small-scale gateway, such as by issuing credits for minutes of your debugging help). They’re working with a few currency exchanges to help them become the first Stellar gateways; once they’re done, you’ll be able to transact in the currencies they provide. In the long term, there will be gateways to cover every payment method that people choose to support. Regulation of initial coin offerings (ICOs) appears inevitable. Over the past couple months, authorities from numerous jurisdictions have issued statements declaring that tokens may be subject to various consumer protection, anti-money-laundering, and securities regulations. Organizations have raised over $1.8 billion through ICOs since January 2017. As organizations continue to raise tens, sometimes hundreds, of millions of dollars in each token sale, it grows increasingly important for industry leaders, lawyers, policymakers, and academics to understand both the ICO regulatory landscape and the economic and technological attributes of the cryptocurrency and ICO space. Even companies that are not directly involved in the blockchain space should be conscious of how ICOs and tokenization could be leveraged in multiple industries. Since launching last year, the quarterly Stellar Build Challenge has galvanized scores of developers from every corner of the globe to build their own applications atop The Stellar Network. Entrants into the Stellar Build Challenge are guided by the Stellar.org team and community in the various community forums and Stellar Public Slack to bring their ambitious and creative projects to fruition, and the results over the past year have shown the real depth of talent in the Stellar development community.

What Is Stellar Lumens Mining?

Latest Stellar Lumens News

Regulatory Strategy for Tokenization and ICOs

White Paper with Luxembourg House of Financial Technology (LHoFT)

Winners of the 4th Stellar Build Challenge