What Is Veritaseum?

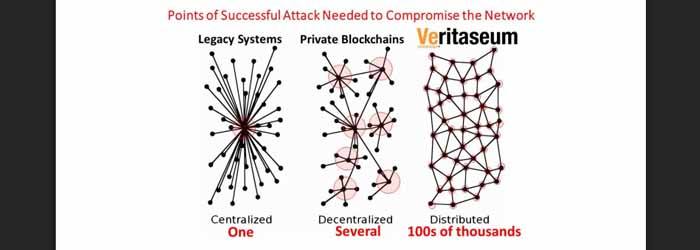

Veritaseum builds blockchain-based, peer-to-peer capital markets as software on a global scale. We are taking a wide swath of assets and exposures and placing them on the blockchain as autonomous software that seamlessly connects to parties without the need for a 3rd or authoritarian interest. Any entity with internet access can participate in these capital markets on a peer-to-peer, over-the-counter, and one-on-one basis.

- Overview - Table of Contents

- What Is Veritaseum?

- Getting Started With Veritaseum

- How To Get A Veritaseum Wallet?

- Veritaseum Resources

- How To Buy Veritaseum?

- Latest Veritaseum News

What is Veritaseum Offering?

Veritaseum software will have two major components - centralized and distributed.

This is an informational paper and it, nor any of its addendums, should not be considered a solicitation - general or otherwise - for the sale of securities or investments. VeApps: the smart contract-based suite of distributed software applications facilitates peer-to-peer, over-the-counter transactions between two consenting parties, and are not designed to be used as a securities or investment exchange.

Veritaseum’s Centralized Solutions

The centralized software platform is designed to cater to existing institutions that are not prepared to take the full leap into distributed capital markets systems. It will run on servers under the control of the client, i.e. the Jamaica Stock Exchange, if they were to enter into a formal agreement with Veritaseum.

A drilldown of the Veritaseum centralized solution for legacy institutions reveals two components:

1. A centralized digital asset exchange designed to be used by an exchange or prime brokerage entity

2. A “smart arbitrage” software component designed to provide cross platform liquidity. An example would be an exchange, i.e. JSE, employs the centralized solution above to trade popular platform-based digital assets such as Bitcoin, Ethereum, Dash and Ripple as well as USD and Jamaican dollars (JMD). The Veritaseum “smart arbitrage” liquidity component determines that the path through USD to JMD to Ethereum to Bitcoin yields a 20bp pricing advantage over the straight purchase of BTC with USD.

Veritaseum’s Distributed Solutions

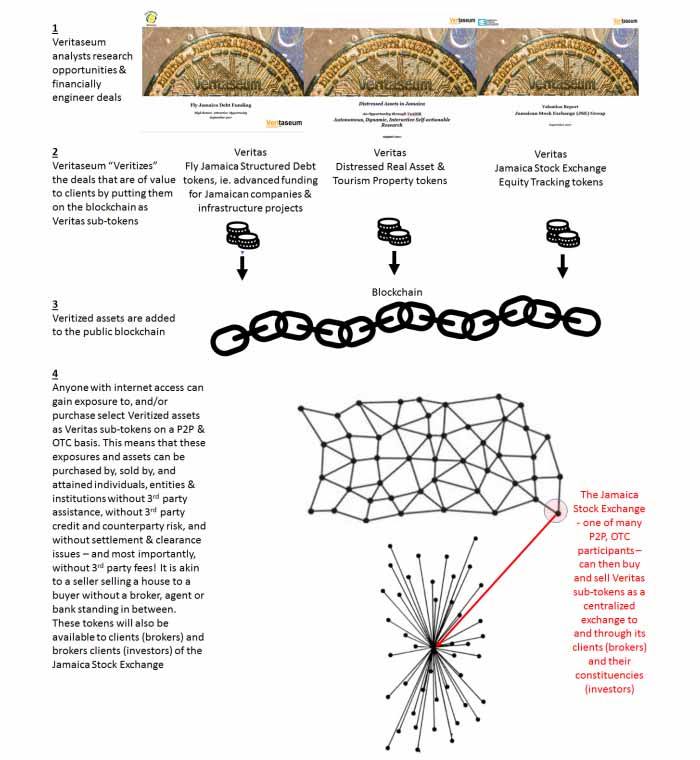

The Veritas sub-token creation process:

1. Goals are communicated to the Veritaseum team by the Veritaseum client/customer.

2. Veritaseum financial analysts, macro strategists and financial engineers create a construct and analytical framework that supports said construct, along with the fundamental and macro research that facilitates the construct.

3. The financial construct is passed on to the Veritaseum software developers and engineers to create the software token and the smart contracts that support the business processes and logic espoused in the construct through the financial analysis.

4. The software token is issued directly to the Veritaseum customer for direct P2P, OTC transfer (again, the Jamaica Stock Exchange makes a perfect prospective client) or to hold - and/or through the appropriate financial machine, i.e. the VeADIR.

Our autonomous products and services sit above the centralized offerings that are designed to ease legacy institutions into the new digitally distributed paradigm. Nearly all of them are ensconced within our research and analysis, which acts as the basis for the creation of the input to the financial machines.

This is an informational paper and it, nor any of its addendums, should not be considered a solicitation - general or otherwise - for the sale of securities or investments. VeApps: the smart contract-based suite of distributed software applications facilitates peer-to-peer, over-the-counter transactions between two consenting parties, and are not designed to be used as a securities or investment exchange.

- Overview - Table of Contents

- What Is Veritaseum?

- Getting Started With Veritaseum

- How To Get A Veritaseum Wallet?

- Veritaseum Resources

- How To Buy Veritaseum?

- Latest Veritaseum News

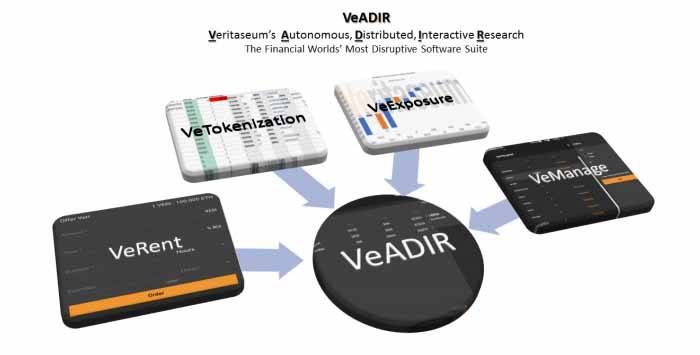

Ideas that are believed to be of value are “Veritized”, converted into Veritas sub-tokens, and entered into our financial machines. The first financial machine to released is the VeADIR (Veritaseum Autonomous, Dynamic, Interactive Research).

The VeADIR is a suite of roughly one dozen smart contracts which drive software applications that are mostly fully distributed and live on the public blockchain. Currently, it consists of about 2300 lines of efficiently written solidity code, and about 800 lines or so of GUI and supporting code. The VeADIR is in rapid development, with several parts currently undergoing public and private beta testing.

Each major function of VeADIR is compartmentalized.

1. VeADIR: An autonomous software construct and Financial Machine that exists to gain exposure to assets and opportunities that allow it to grow its asset base through positive risk adjusted returns. All asset exposure acquisitions are research driven.

2. VeRent: An interface and facility that allows exposure seekers and buyers to acquire or rent Veritas tokens, which are needed to access the Veritaseum Financial Machines, namely the VeADIR software suite.

3. VeTokenization: An automated facility that spins up a custom Veritas sub-token whenever presented with an asset, opportunity or exposure by the VeADIR.

4. VeExposure: A facility that allows those who have gained access to the VeADIR through possession of the Financial Machine’s access keys (VERI) to gain access to the exposures held therein.

5. VeManagement: An administrative interface to manage exposures while the VeADIR software suite learns, grows, and develops into a fully autonomous entity.

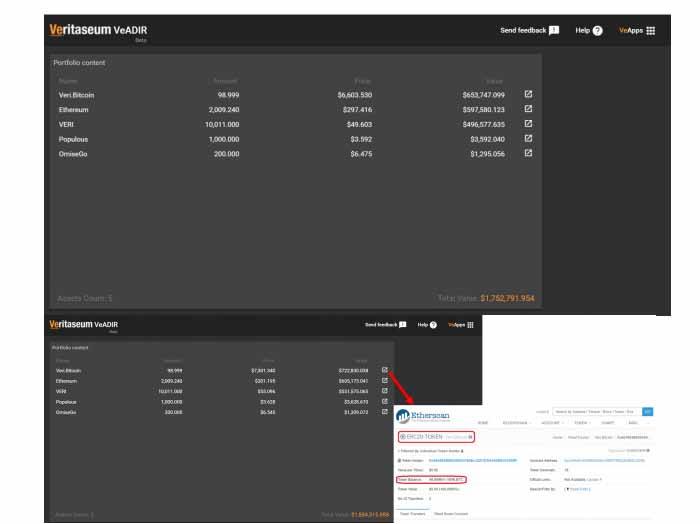

The following describes a material part of the solutions that we are offering institutions during the 4th quarter of 2017. Please be aware that this is an institutional, P2P and OTC product, akin to a real estate purchase between two institutions. It is not intended to be a security nor an exchange. The VeADIR is the product that was demonstrated to the Jamaica Stock Exchange.

VeADIR is an interactive, digital research vehicle that offers exposures to its vetted research subjects. The research takes advantage of distributed ledger (blockchain) and smart contract technology in that it can be both dynamic and applied. This means the research can and will be actionable by this independent construct in near real time. VeADIR is independent from Veritaseum in manner and action. As such, it makes decisions separate and apart from Veritaseum or other entities and it must be considered autonomous and sovereign in its actions and existence.

Communication is performed in machine language to and from the VeADIR summarizing the token purchases, distributions, valuation forensics and market liquidity.

The VeADIR will pay operating fees to Veritaseum (tokens, either USD-locked or other) for real world research. Veritaseum then feeds research results to VeADIR.

Either other smart contracts/constructs (likely preferable, wherein VERI holders can purchase access) or specialized wallets can be used to convert said machine language into lay person readable human language.

Users pay VERI to the VeADIR to receive the contract-processed research that the VeADIR purchases from Veritaseum in machine language. This is likely in the form of what is the most promising blockchain based assets.

This research will look like this in the case of an entity-based token offering (VeADIR will purchase a wide plethora of assets, i.e. from distressed credits to digital platform tokens):

Getting Started With Veritaseum

Veritaseum is a smart contracts-based, peer-to-peer wallet interface (in beta) that currently interacts with Bitcoin blockchain (to be ported to Ethereum).

It allows non-technical individuals & entities to quickly create, enter and manage smart contracts directly with others without an authoritative 3rd party. It was the first of its kind written on a public or private blockchain.

Financial institutions that control most global transactions have a structural deficiency in their business model - overcompensation. Up to 60% of gross revenues are paid out to employees. This "structural deficiency" in the financial entity business model is passed as higher expenses, directly to the consumers of financial products and services. These higher expenses, tend to manifest themselves in manners encompassing more than just greater cost - higher transaction friction, conflicts of interest, material counterparty and credit risks etc.

Veritaseum utilizes smart contracts and blockchain technology to enable individuals and entities to transact directly with each other in a a peer-to-peer fashion, with capital escrowed to the blockchain contingent upon smart contract-enforced, mutually agreed terms. Due to the nature of these "smart contracts", the agreements cannot be broken, contracts cannot be breached and most importantly, each side is forced to deliver under and in all circumstances. This is done without the highly compensated "staff" of extant financial entities at costs that are dramatically lower than the status quo.

- Overview - Table of Contents

- What Is Veritaseum?

- Getting Started With Veritaseum

- How To Get A Veritaseum Wallet?

- Veritaseum Resources

- How To Buy Veritaseum?

- Latest Veritaseum News

Veritaseum is enabling software-driven peer-to-peer (P2P) capital markets without brokerages, banks or traditional exchanges. Veritaseum is a software concern, not a financial concern and no actors on its platform are exposed to its balance sheet in any way, nor does Veritaseum hold, control or have the ability to frustrate access to any participant's capital.

Veritaseum has global (IS, UK, EU, China, Japan) patents pending for the application of its technology for P2P letters of credit and P2P value trading (with long running functional beta facilitating the trading of exposure for over 25K tickers of stocks/bonds/forex/commodities) predating all similar applications management is aware of (ref. pg 18).

DAO's (digital autofocus organizations) are being designed to disintermediate businesses with high structural costs by offering similar services at near zero margin, while funnelling analysis and infrastructure business to Veritaseum (full description).

Dependent upon availability & fortitude of Ethereum public blockchain. Veritaseum strives to be platform agnostic, but man/months (at a minimum) would be required to rewrite for a different blockchain. Regulation in this space has not kept up with the pace of innovation, hence there is ambiguity. If Veritaseum is successful, significant and very heavily capitalized competition will arrive very quickly. Many institutions have already filed multiple blockchain-related patent applications.

Use of Digital Assets

- 30% Research and Development

- 30% Sales, Marketing, Business Development

- 13% Operations

- 10% Legal

- 10% Reserves

- 7% DAO liquidity provisions

How To Get An Veritaseum Wallet?

We need it to be perfectly understood that the Veritaseum token rental facility is a vehicle for conducting peer-to-peer, over-the-counter token transactions. It is not an exchange, nor an offer to buy nor sell securities.

Now that we have gotten that out of the way, we would like to prepare to introduce the rental app ahead of both the more institutional VeADIR and research offerings (reference Veritaseum Autonomous Distributed Interactive Research (VeADIR)). You may download a beta of the rental app here. Please forward all bugs and usability issues to us via the contract form above.

1. General setup

2. Open your Google Chrome browser and setup MetaMask. You can find tutorial here (https://www.cryptocompare.com/wallets/guides/how-to-use-metamask/)

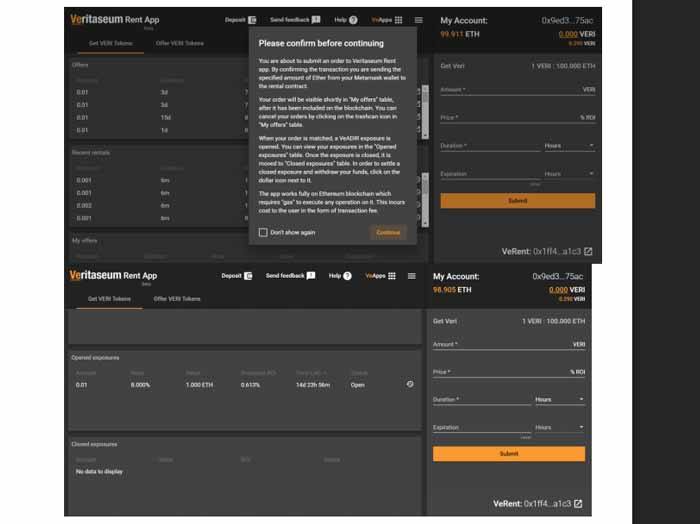

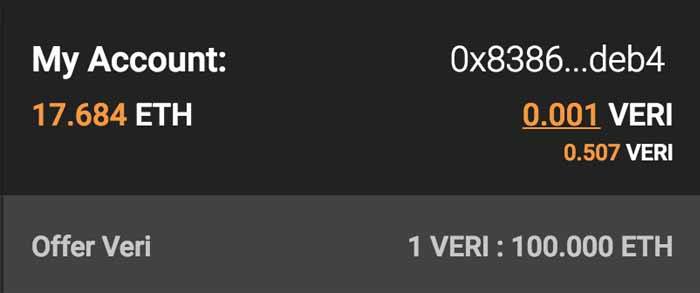

3. Once you have your account ready navigate to VeRent app and verify your active account in the right panel.

4. VeRent consists of two areas, one for token renters “Get Veri Tokens” and one for token owners “Offer Veri Tokens”

How to offer VERI Tokens

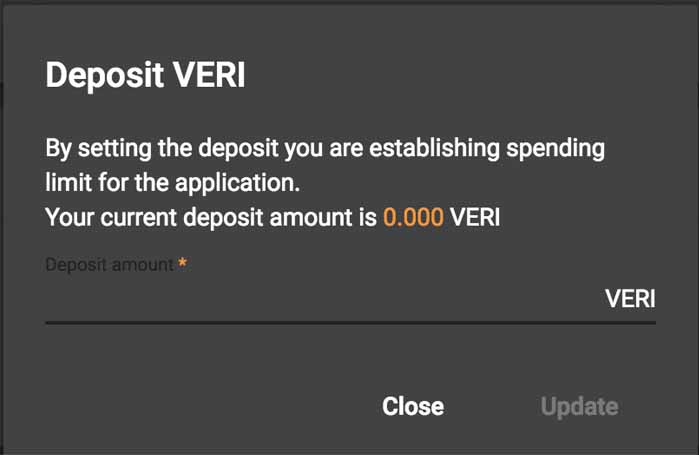

If you would like to offer rental of your VERI tokens navigate to “Offer VERI Tokens” tab and set your VERI deposit by clicking on the “deposit” button in the header. The tokens won't be transferred to the contract just yet, the value is just an allowance for use in the rental app. You will be asked to sign a transaction in a Metamask dialog window.

After the transaction has been accepted, the new deposit value will appear in the sidebar.

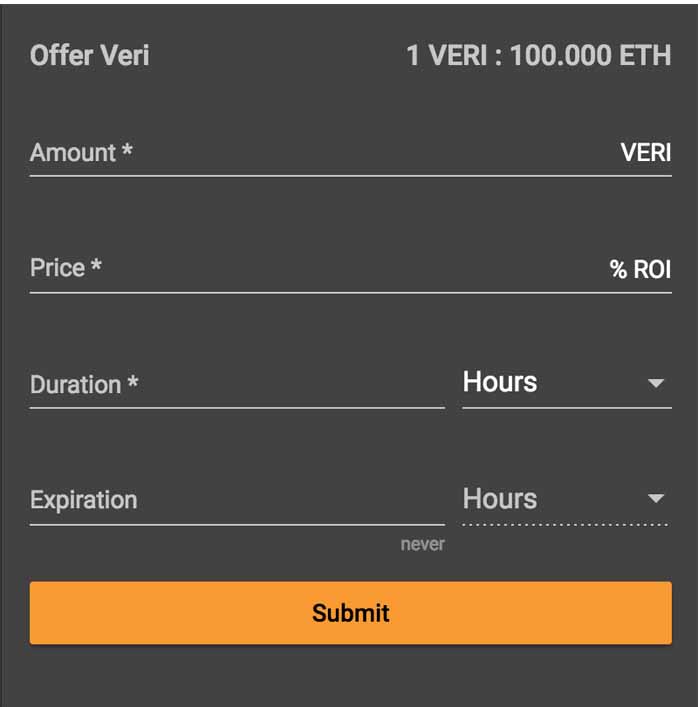

Next, fill the form in the right panel which requires you to provide Amount, Price, Duration and Expiration. Expiration is not mandatory, by default your offer never expires but you can cancel it before it is accepted. On the top of the form you can also find the current ratio of VERI to ETH. After you fill the form, press Order to create new Offer.

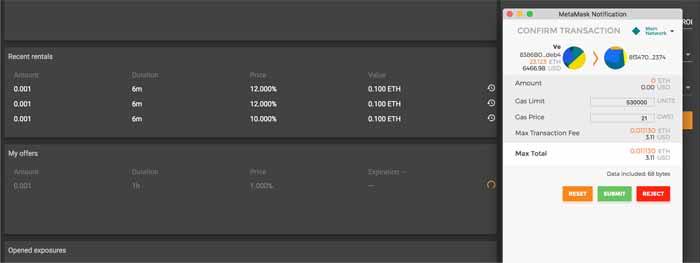

MetaMask plugin will ask you to confirm your transaction in a popup window. Until the transactions is complete and added to the blockchain, you will see a pending transaction in My offers table. Processing on Blockchain takes considerable amount of time, so please arm yourself with patience, usually your transaction should be completed within around 20 seconds.

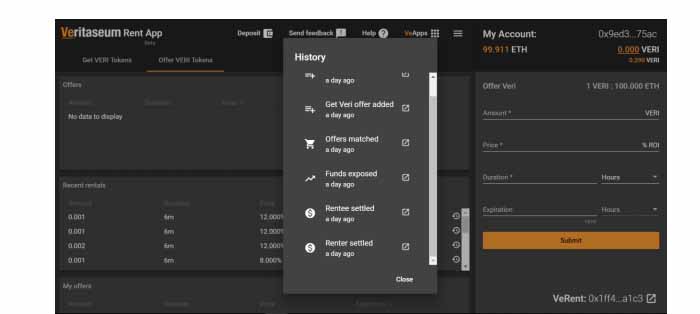

When processing is complete you will see your offer in “My offers” table.

On the right side of the row you can see available actions. To see the transaction in blockchain explorer click “open in new” icon. To cancel the offer click “trash” icon.

Once your offer is accepted it will be moved from “My offers” table to “Opened exposures”. At this point ether and VERI tokens are transferred to the contract. You can track the status of exposure in columns “Time Left” and “Projected ROI” calculated based on the average ROI.

After the exposure time has elapsed, the status changes to “closing”. It may take some time until the exposure is finalized and the funds locked in it available.

Once exposure is closed, it is moved to “Closed exposures” and updated with the actual ROI. You can withdraw your funds. In order to do that, click “coin” icon in the right side of the table row.

Alternatively to creating new offer, you can accept existing ones, You can find them in “Get Veri Tokens” tab “Offers” table. To accept an offer click “shopping cart” icon.

Veritaseum Resources

How To Buy Veritaseum?

If you would like to rent VERI tokens, fill the form in the right panel with Amount, Price, Duration and Expiration. Expiration is not mandatory, by default your offer never expires and you can cancel it before it is accepted. On the top of the form you can also find the current ratio of VERI to ETH. After you fill the form, press Order to create new Offer.

MetaMask plugin will ask you to confirm your transaction in a popup window. Until the transaction is completed and added to blockchain, you will see a pending transaction in My offers table. Processing on Blockchain takes considerable amount of time, so please arm yourself with patience, usually your transaction should be completed within 20 seconds.

When processing is completed you will see your offer in “My offers” table, and given that its not expired yet you can also see it in “Offers” within “Offer Veri Tokens” tab.

On the right side of the row you can see available actions. To see the transaction in blockchain explorer, click “open in new” icon. To cancel the offer click “trash” icon.

Once your offer is accepted it will be moved from “My offers” table to “Opened exposures”. At this point provided ether and VERI tokens are transferred to VeRentExposure. You can track the status of exposure in columns “Time Left” and “Projected ROI” calculated based on the average ROI.

- Overview - Table of Contents

- What Is Veritaseum?

- Getting Started With Veritaseum

- How To Get A Veritaseum Wallet?

- Veritaseum Resources

- How To Buy Veritaseum?

- Latest Veritaseum News

After the exposure time has elapsed, the status changes to “closing”. It may take some time until the exposure is finalized and the funds locked in it available.

Once exposure is closed, it is move to “Closed exposures” and updated with the actual ROI. You can withdraw your funds. In order to do that, click “coin” icon in the right side of the table row.

Alternatively to creating new offer, you can accept existing ones, You can find them in “Offer Veri Tokens” tab “Offers” table. To accept an offer click “shopping cart” icon.

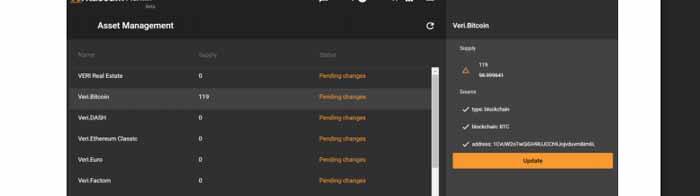

Ve Tokenized Assets Manager

Ve Tokenized Assets Manager consists of admin web app, asset configuration Google Docs spreadsheet and an Ethereum registry contract.

The admin app reads data from a spreadsheet via Google Docs public API and displays asset information in a table for the admin to accept by sending a transaction to the registry contract using their Metamask Ethereum account.

Creating a new asset starts with adding a row with asset information in the spreadsheet. The information includes the name and symbol of the token, type, supply, and a list of key-value pairs defining the source of the tokenized asset.

The spreadsheet periodically fetches information from Etherscan API. Asset properties are highlighted when not in sync with the blockchain.

Any modification made to the spreadsheet (including new token additions) shows in the admin web app. Changes are marked as “new” or “changed” depending on whether they apply to a new token or an existing one.

Selecting a row in the table opens the review dialog pane which allows verifying the details of the change before making it permanent on the blockchain.

After clicking on “Create” button, a standard Metamask transaction dialog shows up. By sending the transaction to the registry contract the admin creates a new Ethereum ERC2-compatible contract representing the tokenized asset.

The “Blockchain” spreadsheet contains read-only data on actual state of tokens on-chain.

Latest Veritaseum News

Veritaseum Signs MOU with Jamaica Stock Exchange for JV on Digital Asset Exchange

They have entered into a memorandum of understanding (MOU) with the Jamaican Stock Exchange to build a jointly owned digital asset exchange. We anticipate a beta launch during the month of October. Our trip to Jamaica during the month of July was obviously very fruitful. Below is pictorial of events.

An early breakfast meeting with the upper management of the Jamaican Stock Exchange at the Pegasus Hotel in Kingston, Jamaica. As time progresses, many of our partners and clients will be able to attest that I bring my children with me to many if not most of my business meetings. They are literally active members of the business. Masiah (big grin, yellow tie) has dealt with many via client interactions and assists in analyzing and strategizing deals.