What Is Bitcoin Gold?

Bitcoin Gold is a fork of the Bitcoin blockchain. At block 491407, Bitcoin Gold miners will begin creating blocks with a new proof-of-work algorithm, and this will cause a bifurcation of the Bitcoin blockchain.

The original Bitcoin blockchain will continue on unaltered, but a new branch of the blockchain will split off from the original chain. The new branch is a distinct blockchain with the same transaction history as Bitcoin up until the fork, but then diverges from it. As a result of this process, a new cryptocurrency born.

- Overview - Table of Contents

- What Is Bitcoin Gold?

- Getting Started With Bitcoin Gold

- How To Get A Bitcoin Gold Wallet?

- Bitcoin Gold Resources

- How To Buy Bitcoin Gold?

- How To Earn Bitcoin Gold?

- What Is Bitcoin Gold Mining?

- Latest Bitcoin Gold News

The purpose of Bitcoin Gold is to make Bitcoin mining decentralized again. Satoshi Nakamoto’s idealistic vision of “one CPU one vote” has been superseded by a reality where the manufacture and distribution of mining equipment has become dominated by a very small number of entities, some of which have engaged in abusive practices against individual miners and the Bitcoin network as a whole.

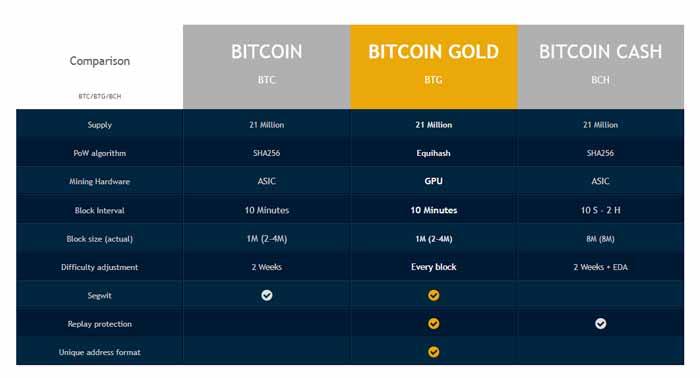

By changing Bitcoin’s proof-of-work algorithm from SHA256 to Equihash, all of the specialized SHA256 mining equipment will be obsolete for mining the Bitcoin Gold blockchain.

Thus, Bitcoin Gold will provide an opportunity for countless new people around the world to participate in the mining process with widely-available consumer hardware that is manufactured and distributed by reputable mainstream corporations. A more decentralized, democratic mining infrastructure is more resilient and more in line with Satoshi’s original vision.

Is Bitcoin Gold a competitor of Bitcoin?

No. Bitcoin Cash and B2X are hostile forks that use the same PoW algorithm as Bitcoin – SHA256 – which results in a permanent state of conflict over a finite amount of ASIC mining hardware that is required for solving SHA256 proof-of-work.

Bitcoin Gold, on the other hand, uses the Equihash PoW algorithm, which cannot be solved using ASICs that have been designed for Bitcoin. This ensures that Bitcoin Gold is not in competition with Bitcoin over limited resources. Instead, Bitcoin Gold will have an entirely different mining infrastructure, consisting of general purpose computer hardware (GPUs).

The Bitcoin Gold (BTG) initial coin distribution method is almost exactly the same as that used by the Bitcoin Cash fork of August 1. Everyone who held Bitcoin when block 491406 was mined will automatically receive Bitcoin Gold at the rate of 1 BTC=1 BTG. (If you had 20 BTC at the time of the fork, you will receive 20 BTG.)

Bitcoin Gold is a community-led project to create an experimental hard fork of Bitcoin to a new proof-of-work algorithm. The purpose for doing this is to make Bitcoin mining decentralized again.

Satoshi Nakamoto’s idealistic vision of “one CPU one vote” has been superseded by a reality where the manufacture and distribution of mining equipment has become dominated by a very small number of entities, some of whom have engaged in abusive practices against individual miners and the Bitcoin network as a whole.

Bitcoin Gold will provide an opportunity for countless new people around the world to participate in the mining process with widely-available consumer hardware that is manufactured and distributed by reputable mainstream corporations.

A more decentralized, democratic mining infrastructure is more resilient and more in line with Satoshi’s original vision. Perhaps, if the Bitcoin Gold experiment is judged by the community to be a success, it may one day help build consensus for a proof-of-work hard fork on Bitcoin itself.

Bitcoin was created for many different reasons and every day, people find new reasons to adopt Bitcoin. One of the historical reason is that people do not trust states or banks or any such intermediaries to control their money.

One of the central component of the Bitcoin architecture is mining. Simply put miners verify every transaction and compete with each other to get rewards. To get the reward, a miner has to solve a math problem before anyone else in the network.

Back in the days, a miner would be any geek with a computer, willing to trade electricity for Bitcoins. Today, a miner is usually a huge warehouse full of very advanced computers, constantly running to solve the math problems as fast as possible.

As it becomes more and more difficult to mine Bitcoin, more capital is required to operate profitable mining operations. They often are located in a country where the electricity is very cheap. Today, a great majority of the miners are located in China because they have access to cheap electricity.

In Satoshi Nakamoto’s white paper, one of the main idea was that every CPU was going to be an equally important part of the network. We want Bitcoin to be a shared and independent currency. We don’t want any fat cat to drive our monetary architecture.

- Overview - Table of Contents

- What Is Bitcoin Gold?

- Getting Started With Bitcoin Gold

- How To Get A Bitcoin Gold Wallet?

- Bitcoin Gold Resources

- How To Buy Bitcoin Gold?

- How To Earn Bitcoin Gold?

- What Is Bitcoin Gold Mining?

- Latest Bitcoin Gold News

The importance of miners in the network is constantly growing. To preserve the independence of the Bitcoin ecosystem from miners’ influence, some people thought that it would be a good idea to change the bitcoin protocol in such a way that more people can have access to Bitcoin mining. That’s why Bitcoin Gold was born, in order to bring Bitcoin mining back to the “people”.

Origins of Bitcoin Gold

In July 2017, Jack Liao, CEO of LightingAsic and BitExchange, made an announcement that he was working on a hard fork of Bitcoin to change the proof-of-work algorithm from the SHA256 algorithm originally selected by Satoshi Nakamoto to Equihash.

The effect of this change will be to enable a whole new class of individuals and businesses to participate in mining this new branch of the Bitcoin blockchain without being required to purchase specialized equipment that is primarily manufactured by one firm that competes against its own customers with newer, more efficient versions of the old equipment that it sells at a high markup.

Given the dysfunctional current reality of the Bitcoin mining sector, it is no wonder that there is a tremendous appetite for a proof-of-work change hard fork. Since the Bitcoin Gold project was announced, it has grown rapidly, attracting developers, miners, and supporters from across the globe.

Getting Started With Bitcoin Gold

DECENTRALIZATION

Bitcoin Gold decentralizes mining by adopting a PoW algorithm, Equihash, which cannot be run faster on the specialty equipment used for Bitcoin mining (ASIC miners.) This gives ordinary users a fair opportunity to mine with ubiquitous GPUs.

FAIR DISTRIBUTION

Hard forking Bitcoin’s blockchain fairly and efficiently distributes a new digital asset immediately to people all over the world who have interest in cryptocoins. Other methods, such as creating coins with a new genesis block, concentrate ownership within a small group.

REPLAY PROTECTION

To ensure the safety of the Bitcoin ecosystem, Bitcoin Gold has implemented full replay protection and unique wallet addresses, essential features that protect users and their coins from several kinds of accidents and malicious threats.

TRANSPARENCY

Bitcoin Gold is a free open source software project that is built by volunteer developers and supported by a rapidly growing community of Bitcoin enthusiasts that stretches around the globe.

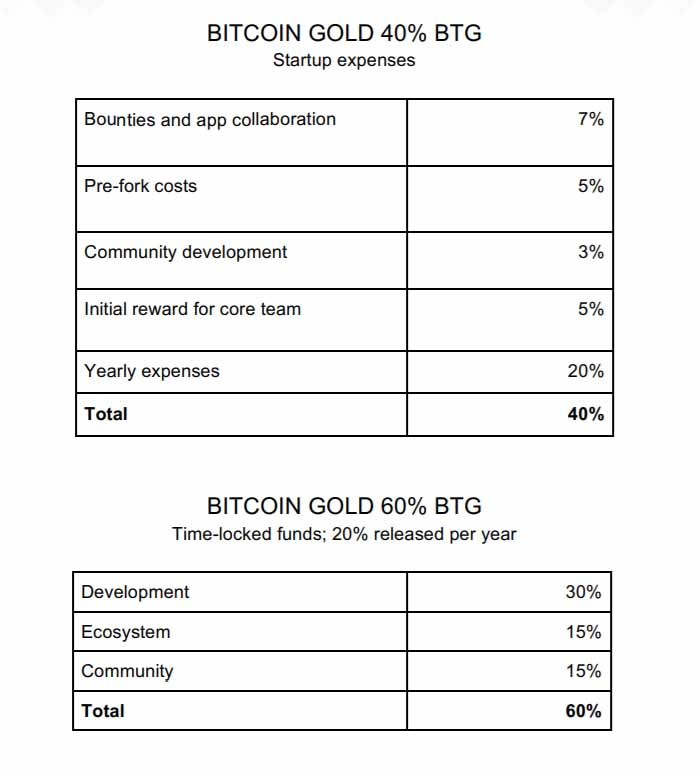

Around the time of the launch, people constantly asked about the premine. “Premine” is not the best term, but we use it to ensure people know what we’re talking about.

Bitcoin Gold chose to fork (replicate) the entire existing Bitcoin blockchain, with all wallet and transaction history included, and then later begin a brief project mining period to build a store of coins to support the future of the project.

This happened after bitcoin block 491,407 (2017-10-24 01:20:39). At that point, there were already 16.5 million Bitcoin in existence, so there were then 16.5 million Bitcoin Gold in existence.

After this, the project mined 100,000 coins (8000 blocks at 12.5 coins per bock), so it’s more of a post-mine, but we still call it a premine. A true pre–mine is when the makers of coin start a new blockchain with a genesis block and do private mining to accumulate a number of coins, and only then make mining public for others earn coin rewards. With that approach, the makers obviously start out with a huge proportion of the initial coin supply – 100%! That’s would have been a serious problem.

- Overview - Table of Contents

- What Is Bitcoin Gold?

- Getting Started With Bitcoin Gold

- How To Get A Bitcoin Gold Wallet?

- Bitcoin Gold Resources

- How To Buy Bitcoin Gold?

- How To Earn Bitcoin Gold?

- What Is Bitcoin Gold Mining?

- Latest Bitcoin Gold News

Our premine accumulation of 100,000 coins was about 0.6% of the total number of outstanding coins (which was about 16.6 million Bitcoin Gold coins after the premine), so it’s a tiny fraction – and is even tinier compared to true pre-mines. The rest of the Bitcoin Gold (BTG) coins are in the hands of whoever held the corresponding Bitcoin wallets before the fork – which includes many thousands of individuals and organizations all around the world.

Today, the Bitcoin Gold blockchain is growing and healthy, with many blocks publicly mined on top of the premine. In that regard, it finally makes a kind of sense to call it a premine.

Summing up the Bitcoin (BTC) and Bitcoin Gold (BTG) supplies:

This is exactly as described in the previously published Bitcoin Gold Roadmap. Moreover, since the blockchain has been continuously mining since launch, these facts can be independently and publicly verified by looking at the blockchain.

The premined coins were all locked up as they were mined

It’s important to note that the code which ran the premine was putting all those coins into “locked” wallets, even as they were being mined.

100% of the coins mined during the premine period were mined directly into multi-signature wallets which cannot be disbursed by any one individual, or even a small group. All disbursements must be signed by four of the six core team members.

Further, 60% of those coins were mined into time-locked wallets which cannot be accessed immediately; they become accessible over the course of the next three years.

This, also, is exactly as described in the previously published Bitcoin Gold Roadmap. Rumors at launch time of any developer’s intent to “dump the premine coins” soon after launch were abundant, but completely false and, in fact, quite impossible!

Again, all of this can be independently verified by knowledgeable people who look at the open-source code that ran the premine.

Most of the coins are locked in an Endowment

The great majority of the premine – 95% – was locked up as funds which are best considered an Endowment. Some (35%) was potentially available for use immediately, and 60% was locked up for the future. The purpose of these funds is to support the growth and maintenance of a healthy ecosystem for Bitcoin Gold, but also to support Bitcoin and the crypto-community generally.

There was, understandably, a lot of attention to the 5% of the premine which was earmarked as “Initial reward for core team” in the Roadmap. That represents 5,000 coins used in order to cover all the costs for the team, infrastructure, development and bounties and they were all covered by the core team.

We will be releasing more information about how the Endowment is being used, and how it is going to be used, in the future. The general plan will be as published in the Roadmap, but we look forward to seeing this project, and the Bitcoin Gold Community, evolve over time!

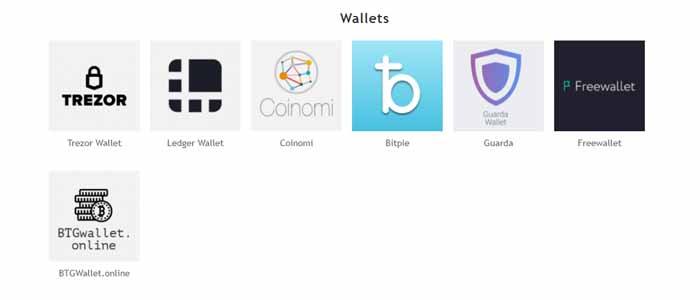

How To Get A Bitcoin Gold Wallet?

Some wallets may offer you direct access to your BTG, while others may require you to take additional technical steps. Verified wallets that support BTC and BTG side-by-side will be listed on the Bitcoin Gold home page. We will publish guides for retrieving BTG from the most popular wallets, including Bitcoin Core, Electrum, Mycelium, hardware wallets, paper wallets, and more.

If you have BTC in a paper wallet, hardware wallet, multi-signature address, or any other form of secure private key storage, you will be able to claim your corresponding BTG at any time in the future.

There is no expiration date for claiming your free BTG. If you have BTC in cold storage that you did not plan to touch for many years, do not change your plans because of this fork. Your BTG will still be there decades from now.

After that time, your options to acquire it will be to buy it on an exchange like any other cryptocurrency, to mine it with your own computer hardware (GPUs), or to earn it by trading your goods and services for it. BTG is already trading on several exchanges listed on the ECOSYSTEM section of the official website.

Zebpay’s support for Bitcoin Gold

Zebpay has made their initial stand on Bitcoin gold, that they will not be supporting it for now but might support it later on. That means you might get your Bitcoin gold later on of they support it.

As far as unocoin's stand, they haven't made any statement on Bitcoin gold, so am assuming they aren't supporting it either.

The best thing would be to transfer your Bitcoin to a wallet that actually has declared that will support Bitcoin gold, or just keep it in zebpay if you have no idea about what to do, as there's still a probability that they might support it later on. If you already have your bitcoin balance in Zebpay account then you should prabably read the blog below from Zebpay:

Our first priority will be ensuring safety of user’s funds in events like hard forks. Secondly, we believe that our users should benefit from forks wherever feasible. However, safety and security are important considerations at Zebpay before supporting a new asset.

Hence, we will not support the Bitcoin Gold fork at this point of time and we will continue to monitor the Bitcoin Gold blockchain. If the network proves to be secure and valuable, we may decide to support it at a later point of time.

- Overview - Table of Contents

- What Is Bitcoin Gold?

- Getting Started With Bitcoin Gold

- How To Get A Bitcoin Gold Wallet?

- Bitcoin Gold Resources

- How To Buy Bitcoin Gold?

- How To Earn Bitcoin Gold?

- What Is Bitcoin Gold Mining?

- Latest Bitcoin Gold News

Zebpay will not sell or keep the Bitcoin Gold associated with a customer for itself. The Bitcoin Gold coins will be safely stored with Zebpay. If Zebpay decides to support the fork at a later point of time, customers would be able to access the Bitcoin Gold balances that are equivalent to their balances at the time of the Bitcoin Gold fork.

Bitcoin Gold Resources

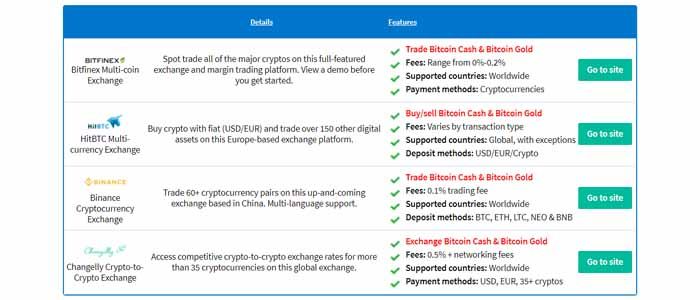

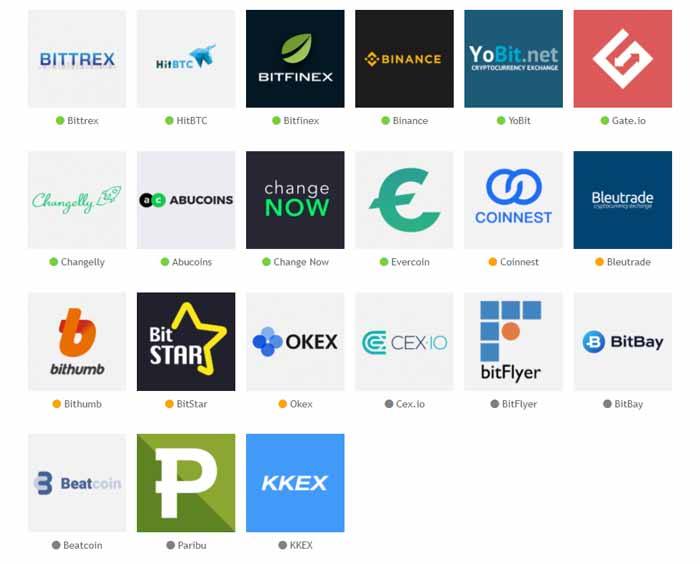

How To Buy Bitcoin Gold?

The Bitcoin Gold home page displays the names and logos of exchanges that are already prepared to credit their users with BTG at the 1:1 ratio. If your exchange is not shown, it would be wise to consult with your exchange for full information on their policy.

Any digital wallet that gives you exclusive control of its keys will work. However, not all wallets will support BTG right away. You’ll still get the coins, but won’t necessarily be able to access them from that wallet right away.

If your BTC is listed on an exchange at the time of the fork, then the exchange holds the keys and not you. Therefore the exchange will be getting the free BTG instead.

They should be crediting you with the BTG, but there’s no legal authority that can force them to do so.

Some exchanges have agreed to credit users with BTG at the proper 1:1 rate, but it’s safe to assume that not all exchanges will. If you have BTC on an exchange at the time of the fork, you should look into whether or not they’ve agreed to give you the newly created BTG.

The following exchanges have all agreed to credit BTC owners with the BTG as appropriate. However you generally need to own a certain amount, such as no less than 0.10BTC in order to get it.

- Bitfinex

- BitBTC

- YoBit

- Bleutrade

- Bitstar

- Coinnest

- BitBay

- BitFlyer

- Beatcoin

- Paribu

- Abucoins

After the fork you’ll be able to buy or mine BTG.

You’ll theoretically be able to start buying and trading it immediately, but functionally might have trouble doing so until around 1 November or slightly later. This is when the BTG code will be released to the public and the first blocks will be mined on the new blockchain. Most exchanges and wallets will start investigating how to implement support for BTG on 1 November, and whether it’s a good idea, then.

Throughout the tail end of 2017 you can expect an increasingly wide range of providers to support BTG.

At the time of writing, you can already buy and sell BTG on the following exchanges:

- Bitfinex

- HitBTC

- Binance

- YoBit

- Bleutrade

- Bitstar

- Coinnest

Is it safe to trade BTG?

Security concerns are one of the main obstacles in the way of immediate BTG trading. In particular, BTG may not yet have replay protection.

So if you want to get in early, but don’t want to take unnecessary risks, it might be worth looking at exchanges that have clearly explained how they plan on handling this.

For example, Bitfinex has adopted a token scheme, by which users can trade tokens representing each chain, and may have limited certain features until they’re confident you can trade securely, while the widely used exchange Coinbase simply announced that it won’t be supporting BTG until the code is made publicly available.

Wallets have similar issues. For example, TREZOR Wallet has said that its BTC owners will get their BTG, but won’t be able to transfer them until BTG replay protection.

Will BTG overtake BTC?

No one can say for sure. There are some factors to consider though.

This fork isn’t like others

Each fork is intended to improve Bitcoin by overcoming certain shortfalls.

Its previous for into Bitcoin Cash (BCH) was designed to improve transaction speeds, and the Segwit2x fork (at block 494,784, projected for 16 November 2017) is intended to do the same.

Both of these use the same SHA-256 algorithm type as BTC. This means they’re in more direct competition with BTC, because there’s only a finite amount of hardware around to mine all three currency types. Essentially miners have to choose which one they’ll spend their resources on.

- Overview - Table of Contents

- What Is Bitcoin Gold?

- Getting Started With Bitcoin Gold

- How To Get A Bitcoin Gold Wallet?

- Bitcoin Gold Resources

- How To Buy Bitcoin Gold?

- How To Earn Bitcoin Gold?

- What Is Bitcoin Gold Mining?

- Latest Bitcoin Gold News

But BTG will be using the Equihash algorithm instead, which cannot be solved using the same purpose-made ASIC BTC mining system. Instead, it’s designed to be mined with general purpose hardware.

This is the currency’s main feature. It’s designed to be decentralized, and to put more of the mining power back in the hands of the masses rather than small groups of investors.

Optimistically, one might see this as contributing to BTG’s success in the long run. Much of the value of BTC is predicated on the assumption that it will someday become the new global currency, and become almost unfathomably valuable.

A properly decentralized currency might have a better chance of actually going all the way. Also, the GPU-based mining could lead to a much wider range of BTG “shareholders” around the world, rather than having the currency’s value centered around smaller groups of wealthy investors. This might make it more robust and reduce volatility.

On the other hand

One might consider whether or not BTG’s new mining architecture can effectively decentralize the currency, and whether that will necessarily be good for its value. In some ways, BTC’s increased centralization and “potential for abuse” might be helping drive its growth.

There have also been a number of snags, such as a distributed denial-of-service (DDOS) attack shortly after launch which prevented it from functioning, according to Motherboard, and a potential range of technical issues.

According to Forbes, users are also reporting difficulties connecting to other nodes of the network, which might strike directly at the main benefits and points of difference offered by Bitcoin Gold.

The future of BTG is uncertain. Its rocky start might give investors more chance to get in while it’s cheap, or might be a clear warning sign to stay away. The success of BTG likely depends on whether it’s able to overcome any reliability and technical issues, and whether doing so actually ends up translating into more investment.

How To Earn Bitcoin Gold?

Cryptocurrency exchanges are custodial businesses, which means they control your private keys, not you. A exchange that was holding BTC on your behalf at the time of the snapshot will also receive the corresponding BTG. While they should credit your account with the equal amount of BTG, there is no legal authority that can force them to do so.

The Bitcoin Gold home page displays the names and logos of exchanges that are already prepared to credit their users with BTG at the 1:1 ratio. If your exchange is not shown, it would be wise to consult with your exchange for full information on their policy.

You can sell your BTG at any of the exchanges listed on our home page. You can also sell your coins in a private trade with a trusted broker.

Where To Spend Bitcoin Gold?

What Is Bitcoin Gold Mining?

You can solo mine BTG using the full node client or you can mine with a pool. Some public mining pools that have worked with us are listed on our home page. We invite you to join our Slack #mining channel for technical help and advice about mining BTG.

Mechanics of a Hard Fork

Bitcoin is a distributed consensus system. All Bitcoin full nodes are running software that enforces the same consensus rules; full nodes that enforce different consensus rules are not part of the Bitcoin network, by definition.

If a miner finds a new block that follows the network consensus rules and broadcasts it to the network, all full nodes in the network will accept that block and all of the transactions in it as valid, and miners will build the next block on top of that one. A blockchain hard fork occurs when a block is mined that does not comply with the network consensus rules.

Prior to BTC block 478558, Bitcoin nodes and Bitcoin Cash nodes were still enforcing the same consensus rules and accepting the same blockchain as valid. But from that block onward, Bitcoin Cash’s new consensus rules came into effect, which caused Bitcoin nodes to reject blocks that were mined by miners using Bitcoin Cash software, and Bitcoin Cash nodes to reject blocks that were mined by miners who continued to mine with Bitcoin software. Thus, the network bifurcated.

The Bitcoin blockchain continued to add a new block every 10 minutes on average, but Bitcoin Cash began building a new blockchain that branched away from Bitcoin. This had the effect of creating a new cryptocurrency that shares the same transaction history and ownership distribution up until the fork block, but then diverges from it.

Bitcoin Gold changes different consensus rules than Bitcoin Cash did, but it will fork from Bitcoin in the same manner - by enforcing new consensus rules as of a predetermined BTC block height. The new rules will come into effect at block 491407. From this block onward, Bitcoin Gold miners will begin building a new branch of the Bitcoin blockchain.

This new branch is a cryptocurrency with same transaction history and ownership distribution as Bitcoin at the fork block; if you hold BTC, you will automatically receive an equal amount of BTG.

Proof-of-Work Algorithm

Bitcoin mining is a proof-of-work system that implements “a distributed timestamp server on a peer-topeer basis.” This is how the Bitcoin manages to maintain consensus across a vast, globally-distributed, permissionless network of nodes.

Satoshi Nakamoto chose SHA256 as the algorithm to use in the original design of Bitcoin’s PoW system. SHA256 served Bitcoin well during the early years of its existence, but as Bitcoin became more popular and more valuable, competition in mining became more fierce.

Skilled engineers from a small number of companies developed Application Specific Integrated Circuits (ASICs) that could perform SHA256 calculations millions of times faster and more efficiently than any other computer. This made non-specialized computer hardware obsolete for mining Bitcoin. Satoshi’s vision of “one-CPU-one-vote” was replaced by one-ASIC-one-vote.

Now, the only way to participate in Bitcoin mining is to buy hardware from one of those manufactures - the biggest of which is believed to manufacture over 70% of the global supply of SHA256 ASICs. This has led to a situation where one entity can hold the entire network hostage, and this is exactly what happened when the backwards compatible Segregated Witness upgrade was blocked by a faction of miners, despite there being universal consensus from Bitcoin experts that it should be activated.

In order to counteract this concentration of power in the mining sector, Bitcoin Gold will implement a new proof-of-work algorithm - Equihash. Replacing the SHA256 algorithm means that all of the ASICs designed for Bitcoin will be useless for mining Bitcoin Gold.

Equihash is a memory-hard algorithm that can be most efficiently solved by GPUs - a standard type of computer and smartphone hardware that is manufactured by mainstream companies and available around the world.

With ASIC manufacturers out of the picture, Bitcoin Gold will provide an opportunity for a whole new class entrepreneurs and investors to get involved with mining. Bitcoin Gold mining will be decentralized again, closer to Satoshi’s original vision.

- Overview - Table of Contents

- What Is Bitcoin Gold?

- Getting Started With Bitcoin Gold

- How To Get A Bitcoin Gold Wallet?

- Bitcoin Gold Resources

- How To Buy Bitcoin Gold?

- How To Earn Bitcoin Gold?

- What Is Bitcoin Gold Mining?

- Latest Bitcoin Gold News

ASIC-resistance is a permanent attribute of Bitcoin Gold. It is much more difficult to create ASICs for a memory hard algorithm like Equihash than SHA256, however it is not impossible. If the day ever comes when Equihash ASICs begin to proliferate and mining begins to centralize again, Bitcoin Gold will have another hard fork to implement a new PoW algorithm.

Difficulty Adjustment Algorithm

In Bitcoin, the difficulty of mining adjusts every 2016 blocks (approximately two weeks) in order to maintain an average interval of 10 minutes between blocks. If the average time between blocks was less than 10 minutes, the difficulty will increase; if the average time was more than 10 minutes, the difficulty will decrease.

Bitcoin Gold will adopt a difficulty adjustment algorithm called DigiShield V3. The idea behind it is to look at how much time has elapsed between the most recent block and the median of a set number of preceding blocks, and to adjust the difficulty every block to target a 10 minute block interval.

This more responsive difficulty adjustment algorithm is extremely useful in protecting against big swings in the total amount of hash power. Such swings can result in extreme deviation from the normal 10 minute target block interval.

Bitcoin Cash attempted to protect against this risk by implementing an “emergency difficulty adjustment” algorithm, but that had the catastrophic effect of causing sometimes 50 blocks to be mined in one hour, and other times more than 12 hours between two blocks.

Replay Protection

The risk of a replay attack is inherent to every cryptocurrency hard fork and has to be taken into consideration to protect users from losing their funds. A hard fork is an exact duplicate of the blockchain, and as such, a transaction that is broadcast publicly to the network can be replayed on both sides of a fork, unless replay protection is implemented.

Bitcoin Gold will implement a solution called SIGHASH_FORK_ID replay protection. It is an effective two-way replay protection mechanism that enforces a new algorithm to calculate the hash of a transaction so that all the new Bitcoin transactions will be invalid in Bitcoin Gold blockchain and vice versa. Bitcoin Gold will implement replay protection BEFORE THE LAUNCH.

Unique Address Format

By default, both sides of a cryptocurrency hard fork will continue to use the same address format. That means it’s possible to send coins to an address on the other blockchain unintentionally, which can cause users to lose funds by mistake.

Bitcoin Cash, for example, is a hard fork that did not change the address format; its addresses are indistinguishable from Bitcoin addresses. There have been many reports of people accidently sending their BTC to a BCC address and vice versa. In some cases these coins could be permanently lost.

In order to ensure that this potential confusion does not exist in Bitcoin Gold, a unique address format will be implemented. The prefix of PUBKEY_ADDRESS and SCRIPT_ADDRESS will be changed to a new prefix (yet to be determined) that can easily be distinguished from Bitcoin addresses.

How to Acquire Bitcoin Gold

The hardfork will occur on block 491407. To acquire free Bitcoin Gold you simply have to hold Bitcoin at the time of the fork. If you hold BTC at that time, you will automatically receive an equal amount of BTG at the same address (new and old address format are convertible), spendable with the same private keys, when the Bitcoin Gold network launches in November. It is also very important to make a backup of your private key and/or keep the mnemonic phrase required to recover your wallet.

However, if you have your BTC on an exchange or custodial service without access to the private key, then you have to make sure that the service will support Bitcoin Gold after the fork. If you have any doubts about that, then you would be advised to transfer your BTC to one of the many reputable services that will support it.

Timeline

Usually a hard fork will happen at the same time when Bitcoin reaches the fork block. However, Bitcoin Gold uses a different way to launch the hard fork: by “taking a snapshot” of the Bitcoin blockchain before the fork block height 491407. Instead of forking immediately, the Bitcoin Gold p2p network will launch a few days later from that snapshot.

When Bitcoin reaches the block 491407, nothing special will happen. Bitcoin block 491407 will be mined with SHA256 as normal. No block will be mined in the Bitcoin Gold p2p network because it is not launched yet.

However, when the full node client of Bitcoin Gold is ready a few days later, instead of mining from the latest Bitcoin block, Bitcoin Gold will start to mine its own 491407th block on top of block 491406. Bitcoin Gold full nodes will only accept a block 491407 that is mined with Equihash, so they will not recognize BTC block 491407 as a valid BTG block.

At the same time, Bitcoin already have a longer blockchain. That’s why it’s called a “snapshot hard fork”. We didn’t follow the common realtime hard fork pattern because a PoW change means there will always be a gap between the fork block.

The first Equihash block will be block 491407 of the Bitcoin Gold blockchain, and from that point on GPU miners participating in the Bitcoin Gold network will begin mining more Equihash blocks on top of it. In this way, the Bitcoin blockchain will bifurcate and a new coin - Bitcoin Gold (BTG) - will be created.

Everyone who holds BTC at block 491406 will then control an equal amount of coins on the BTG blockchain branch, which can be spent at any time in the future with the corresponding private keys.

If you have BTC in a paper wallet, hardware wallet, multi-signature address, or any other form of secure private key storage, you will be able to spend your corresponding BTG at any time in the future. There is no expiration date for your BTG. If you have BTC in cold storage that you did not plan to touch for many years, do not change your plans because of this fork. Your BTG will still be there decades from now.

In 491407 hard fork is the one and only opportunity to get initial BTG. After that time, your options to acquire it will be to buy it on an exchange like any other cryptocurrency, to mine it with your own computer hardware (GPUs), or to earn it by trading your goods and services for it.

Cryptocurrency exchanges are custodial businesses, which means they control your private keys, not you. When the Bitcoin Gold fork occurs on block height 491407, any exchange that is holding BTC on your behalf will also receive the corresponding BTG. While they should credit your account with the equal amount of BTG, there is no legal authority that can force them to do so.

The Bitcoin Gold home page will display the names and logos of exchanges that have promised to credit their users with BTG at the 1:1 ratio. If your exchange is not shown, please consider transferring your BTC to a supporting exchange or withdraw to a personal wallet where you control the private keys.

Financial Strategy

In order to support the current and future development of Bitcoin Gold, the first blocks after the fork will have a reduced difficulty level that will allow the development team to mine these blocks very rapidly, and then the new difficulty adjustment algorithm will kick in and everyone will have the opportunity to mine on equal footing.

As a result, the Bitcoin Gold development team will manage 0.476% of the total coin supply, which will be the main source of funding for all future development of this project, including valuable research and testing that may one day help bring about consensus for a proof-of-work change on Bitcoin itself.

- The initial BTG mined by the Bitcoin Gold (0.476%) development team will be held in multisignature wallets.

- 60% of the funds will be time-locked and released in proportional amounts over the course of three years to cover the development costs.

- All significant expenditures will be made fully transparent according to the best practices of similar open source projects.

- The majority of funds will be allocated as developer bounties, which will be published as issues in the BTCGPU GitHub repository.

- Everyone is able to participate in the Bitcoin Gold developer bounty program; to win the bounty, you must provide the open source code that meets the specific requirements.

The Bitcoin community will be able to support these bounties by buying or holding BTG, as the price of the coin will determine how strong of an incentive these bounties are, and how soon these features can be created.

Keep in mind that most of these development bounties are designed to benefit the entire Bitcoin ecosystem, not only the Bitcoin Gold fork. Bitcoin Gold itself was designed to be a feature of Bitcoin, not a rival.

Some of these essential functions will be performed by full-time employees while others will be outsourced to third-party professional services. All of these expenditures will be made as transparent as possible without compromising operational security.

Bitcoin Gold is a free open source project that was created by a small group of Bitcoin enthusiasts from diverse backgrounds. In contrast to the other prominent Bitcoin forks, Bitcoin Gold was specifically designed from the beginning to inspire innovation in the Bitcoin ecosystem and give value to the vision of decentralization.

- Overview - Table of Contents

- What Is Bitcoin Gold?

- Getting Started With Bitcoin Gold

- How To Get A Bitcoin Gold Wallet?

- Bitcoin Gold Resources

- How To Buy Bitcoin Gold?

- How To Earn Bitcoin Gold?

- What Is Bitcoin Gold Mining?

- Latest Bitcoin Gold News

Whereas the others were born from hostility and an ambition to dominate, Bitcoin Gold arises from a desire to protect Bitcoin and ensure that it not only maintains its position as the dominant cryptocurrency but continues to grow until its liberating roots stretch deep into the economic life of all nations.

Latest Bitcoin Gold News

Safety is Critical

The Bitcoin Gold team wants to encourage individuals and organizations, large and small, to develop software and businesses in the crypto space. To that end, we frequently share information as new providers arise, and we are always pleased when traditional providers announce support for BTG.

On the other hand, this means that we are targets for impersonation – there have been very many fake “Bitcoin Gold” sites and social media channels sharing the news of new “services” which are not legitimate, and countless fake accounts made under the names of Bitcoin Gold’s core team. This is done in an attempt to con you into trusting the fake services.